Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Uniswap (UNI) price has retraced from the bullish momentum it started the year with and is changing hands at $5.3 atop a 2.7% drop. When its price over the past year is compared to its ecosystem and user count, the contrasting growth in Uniswap becomes more evident.

Over the past year, Uniswap has lost far more than 69.2% of its value with the price slipping from the 52 high of $18.10 its current price. The price slump is a function of the intense crypto winter that has kept the majority of crypto assets bound. Besides this broader ecosystem sentiment, Uniswap notably recorded a number of ecosystem and protocol disruptions that further led to sell-offs in its price in 2022.

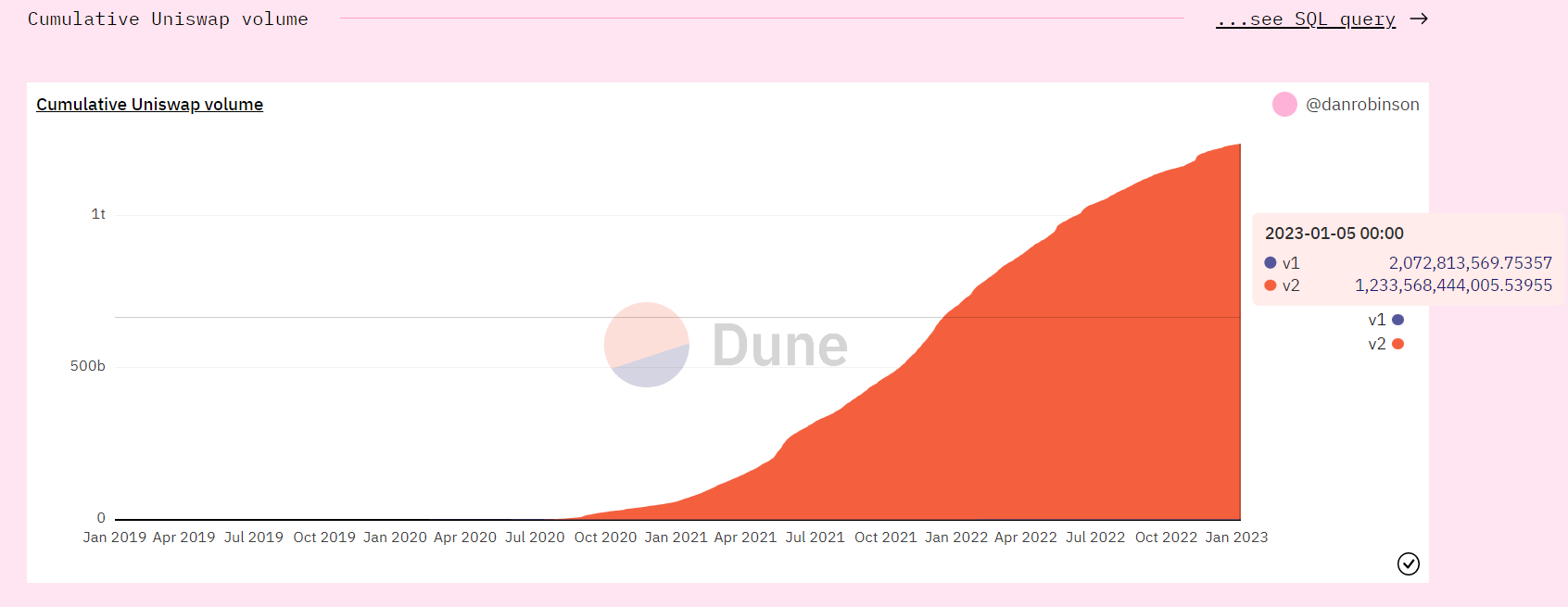

Amid this bearish sentiment, on-chain data from Dune Analytics showed that Uniswap has recorded a significant upshoot in its total transaction count. As of January 2021, Uniswap V1 had a total transaction count of 2,030,512,219.84, while V2 had a user count of 700,648,927,217.363.

As of today, the user count on V1 topped the previous one with a total of 2,072,813,569.753, while V2 came in at 1,233,568,444,005.539.

The higher transaction count, however, did not imply a higher volume as the total volume at the moment is pegged at $2.18 billion compared to the $15.87 billion recorded a year ago.

Uniswap DeFi relevance

Despite the current outlook in the crypto ecosystem, Uniswap still occupies a very pivotal point in the decentralized finance (DeFi) ecosystem. Uniswap has maintained its dominance as the second-largest decentralized exchange, trailing only dYdX by trading volume.

The exchange has a robust pathway for innovation, upgrades and developments, and the latest transition of Ethereum from proof of work (PoW) to proof of stake (PoS) will also enhance the protocol's overall functionality in the coming years.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov