Prominent chartist Peter Brandt has retaliated against crypto Twitter by posting his made-up “six-blind-mice” signal when commenting on Bitcoin’s price action. Believe it or not, but some of his followers were actually tempted to google this.

With such an obvious tongue-in-cheek tweet, he apparently wanted to show the insignificance of short-term price patterns, urging traders to focus on the long-term picture.

Come on you amateurs, you can do better than this. You are missing the forest from the trees. This is a 28-month coil with the price action most recently being the famous "six-blind-mice signal." Get with it. pic.twitter.com/YjKpFBwpG7

— Peter Brandt (@PeterLBrandt) April 28, 2020

Missing the forest for the trees

The tweet that caught the attention of the legendary trader shows that Bitcoin appears to be simultaneously forming two patterns -- a rising wedge and an ascending channel. While the former is bearish, the latter indicates the continuation of the upside price action, which is why traders are trying to figure out which one of them will eventually play out.

The only thing that matters to Brandt is that BTC has been in a coiled market for 28 months after violating its parabolic advance in January 2018. While the coin’s fundamentals scream “buy,” its price has been suppressed, but it is expected to eventually snap back with a major move.

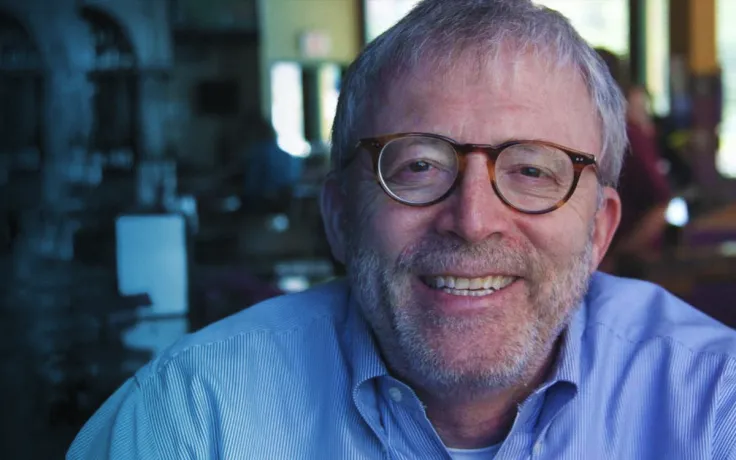

Brandt is back on crypto Twitter

It’s unclear whether the chartist has once again turned into a raging bull once again. After the March 12 flash-crash, he tweeted that BTC had a higher chance of going to $0 than $100,000.

Recently, he claimed that he would no longer tweet about BTC because of “disrespectful trolls.”

Despite a slew of Brandt’s eerily prescient price predictions, the recent uber-bearish call earned him blistering criticism from crypto-enthusiasts since it most likely marked the bottom of the correction.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov