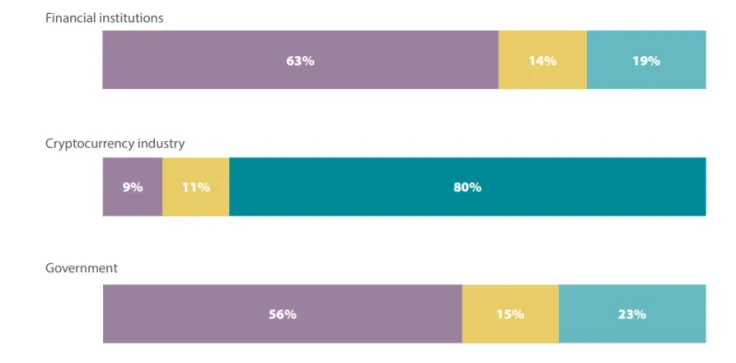

More than 60 percent of financial institutions surveyed by the Association of Certified Anti-Money Laundering Specialists and the Royal United Services Institute believe that cryptocurrencies are risky due their rampant criminal use.

The lion’s share of government officials who took part in the poll also share the same sentiment regarding the nascent asset class.

Rick Mcdonell, the executive director of ACAMS, says that it highlights how crypto is perceived around the globe:

“The results of this survey give a unique global insight into how respondents from governments, financial institutions and the crypto industry itself think about cryptocurrency: it’s potential and it’s risks. Their views are well worth noting as policy making and regulatory enforcement continue to take shape around the world.”

Illegal use cases are the main concern

Overall, 566 professionals from various industries provided their responses. Most of them are familiar with Bitcoin and Ethereum (96 percent and 66 percent, respectively).

69 percent of them agree that digital assets are way too volatile to be a viable replacement for fiat currencies.

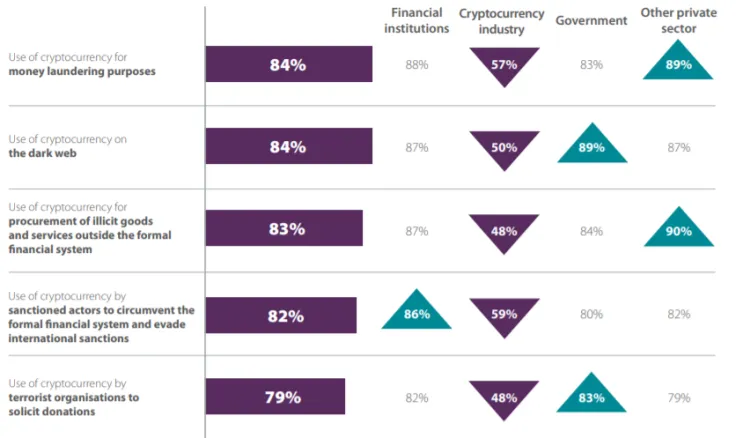

An overwhelming majority of the respondents (70 percent) claims that criminal activity remains their top concern.

Money-laundering is the most worrisome illicit use case of cryptocurrencies for 80 percent of all survey participant. It is followed by the use of crypto for purchasing illegal goods on the dark web, circumventing sanctions, financial terrorist organizations, and sponsoring human trafficking.

Notably, initial coin offerings (ICO) that preceded the decentralized finance mania were also mentioned among the top risks associated with crypto.

The one thing everyone agrees on

The survey vividly shows that financial institutions and governments are yet to welcome the new asset class with open arms despite major leaps made towards their institutional adoption in the recent years.

Naturally, there is a clear schism between legacy finance and the cryptocurrency industry when it comes to risk perception. Less than 10 percent of those respondents who represent cryptocurrency firms view cryptocurrencies as risky.

It also highlight the geographical divide, with those financial institutions that are based in Asia being more crypto-friendly.

However, there is one issue when all sides are on the same page – an urgent need for regulatory clarity.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin