Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Stablecoin issuance is a significant indicator of a blockchain network's health and adoption. It represents the amount of stablecoins that are created and used on a platform. Similar to the way the market celebrates issuance of additional Tether, any kind of issuance on Solana is an indicator of growing capitalization.

Rising stablecoin issuance on Solana suggests increased activity and demand, which could lead to more transactions and higher usage of the SOL token for transaction fees and staking.

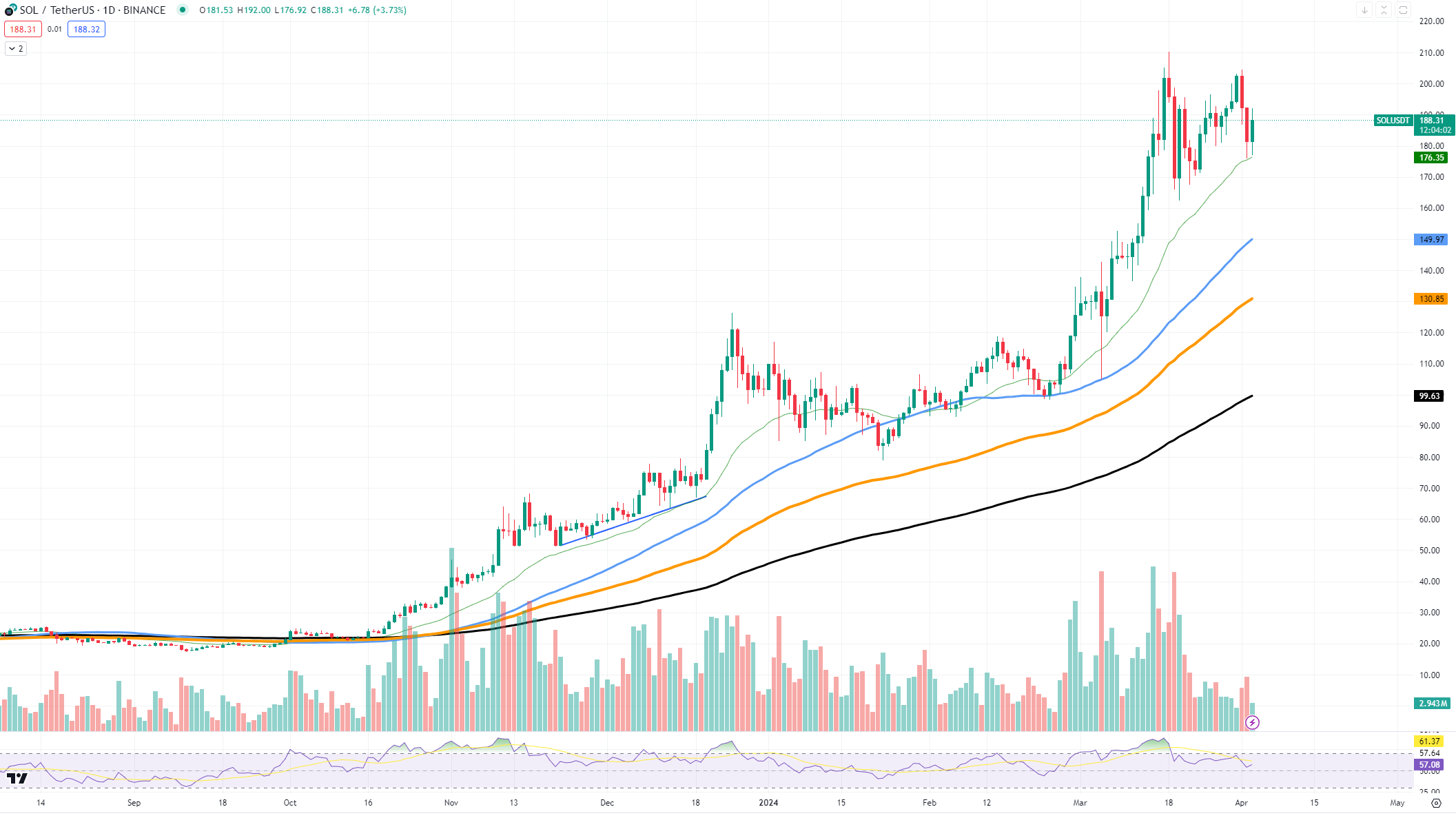

Looking at the Solana price chart, the increase in stablecoin activity may align with promising price support levels. Currently, Solana’s price seems to be holding steady around the $180 mark. Should this trend continue, it would indicate a strong level of support, providing a foundation for potential future growth.

The chart also shows that Solana has previously touched higher resistance levels near $200. If the uptick in stablecoin issuance translates into higher network usage and more widespread adoption, we could see Solana’s price test these resistance levels again. A break above could confirm a bullish trend, possibly paving the way for further gains.

For investors and traders of Solana, the key support level to watch is around $149, which could act as a springboard for a price rebound. On the upside, the next resistance to conquer would be at the recent high of $187.

Despite increased issuance, it is important to understand underlying mechanisms behind price formation on Solana or any other cryptocurrency out there. While the network's usage may increase drastically, it still depends on the market in general. Inflows to Solana specifically might not always translate into bullish performance of SOL.

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide Denys Serhiichuk

Denys Serhiichuk