Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

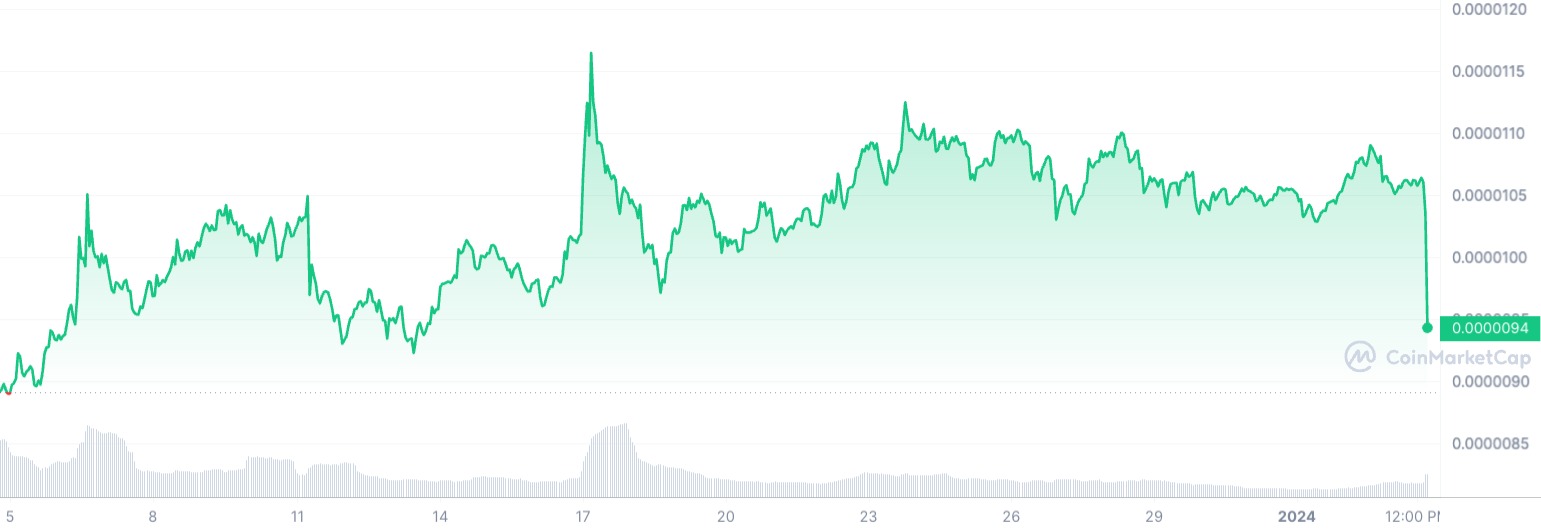

In a startling turn of events, the Shiba Inu token (SHIB) has plunged to a new monthly low, shedding a staggering 22% in the past two hours. As a result, the SHIB price has stagnated at $0.0000094 per token, adding zero value amid a $500 million crypto market bloodbath.

The sudden collapse of SHIB's value is part of a broader downturn on the cryptocurrency market. CoinGlass reports that nearly half a billion dollars' worth of positions were liquidated within a mere hour, with a staggering 91.3% being long positions. This massive deleveraging event has sent shockwaves throughout the crypto space.

Amid this turmoil, SHIB-linked derivatives have experienced a surge in trading volume, witnessing a 150% increase. However, open interest has simultaneously declined by 20%, highlighting the deleveraging character of this dump.

Rumors about spot Bitcoin ETF

The trigger for this downward spiral appears to be a seemingly ominous message from Matrixport. The crypto financial services company anticipates that the SEC will deny all issuers the ability to create spot Bitcoin exchange-traded funds (ETFs) come January 2024.

Matrixport warns of potential cascading liquidations if the SEC fails to give the green light, predicting a Bitcoin price range of $36,000 to $38,000, according to their analysts.

With the Jan. 10 deadline looming for the SEC's decision on the spot Bitcoin ETF, the crypto market is bracing for heightened volatility. As the date approaches, insider information of varying reliability is permeating the industry, adding an air of uncertainty that is sure to test the nerves of market participants in the days to come.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov