Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

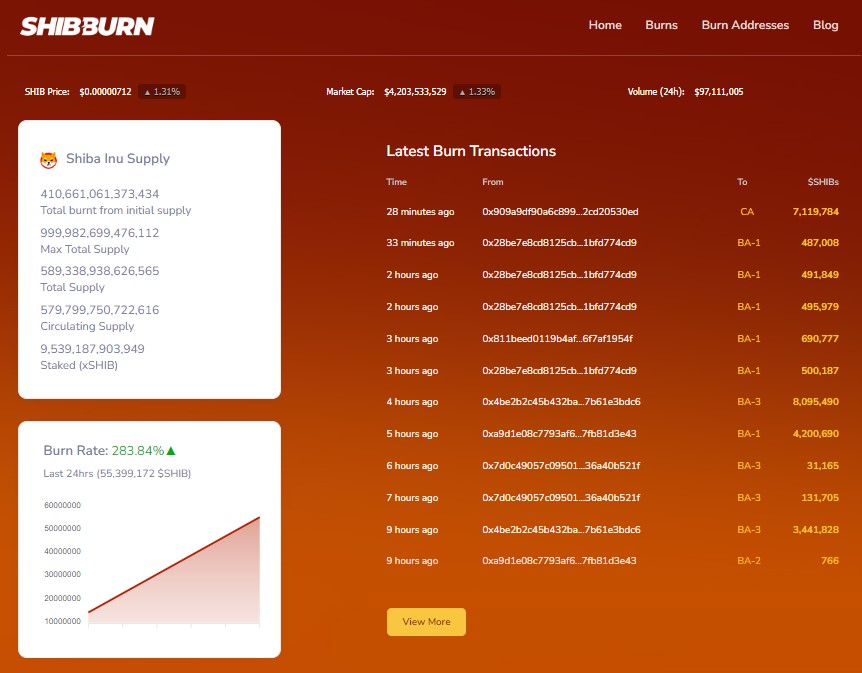

Shiba Inu (SHIB) is starting the week on a positive note as its deflationary metric, the burn rate, just soared to a new unprecedented level. Per data from Shibburn, the burn rate is up by more than 283%, with a total of 55,399,172 SHIB tokens sent to dead wallets overnight.

According to a review of the Shibburn data, there are more wallets involved in the incineration of these SHIB tokens than before. Tiny chunks of the tokens, rather than a lump sum, are now being burnt, showing the deflationary tendencies of Shiba Inu are becoming more decentralized.

With the consistency recorded in the burn rate thus far, overall SHIB tokens sent to dead wallets have far surpassed 410.6 trillion, a figure that is gradually keeping pace with the circulating supply of over 579 trillion SHIB tokens.

The Shiba Inu burn metric is coming at a time when the broader digital currency ecosystem is experiencing a bullish comeback from the lows recorded over the past few weeks. The positive burn rate can serve as a push for SHIB investors to go all out on the token in hopes it will help drive a rally.

Potential impact on price

As far as the Shiba Inu token is concerned, there are a lot of fundamentals helping to drive growth within its ecosystem. After a period of long negative drawdown, the combination of all these bullish triggers is needed to not just help SHIB maintain its current support but to also break a new resistance.

The token is up by 1.3% to $0.000007119 at the time of writing, per data from CoinMarketCap. At this pace, it is on track to first pare off its weekly losses and then retest the resistance point at $0.0000075 in the near to long term.

Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide Arman Shirinyan

Arman Shirinyan Gamza Khanzadaev

Gamza Khanzadaev