According to data provided by on-chain analytics firm Glassnode, Bitcoin miners now derive close to 15 percent of their revenue from transaction fees.

This is the highest level since early 2018 when the cryptocurrency industry was in the middle of the retail-driven crypto frenzy.

Miners revenue from Bitcoin fees spiked to early 2018 levels

— Unfolded (@cryptounfolded) May 19, 2020

data: @glassnode pic.twitter.com/45bPxmx1D3

Bitcoin is becoming more expensive

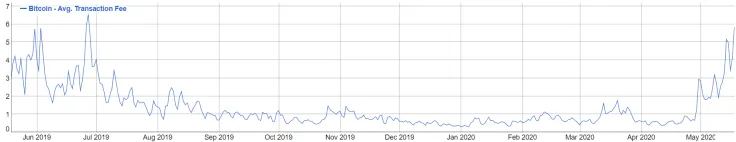

Bitcoin’s average transaction fee has skyrocketed to $5.83, BitInfoCharts data shows.

The world’s leading cryptocurrency hasn’t been this expensive to send since June 27, 2019, the day the BTC price reached its 2019 high of nearly $14,000.

Still, Bitcoin’s transaction fees don’t come close to the previous bull run when they peaked at $54.90 on Dec. 21, 2017.

As reported by U.Today, investor Ari Paul believes that high fees are an acceptable trade-off if they come with security and decentralization.

The reason behind high fees

This time, Bitcoin’s fees are on the rise due to the recent 50 percent reduction of the miner’s reward that has significantly slowed down block production.

This has led to significant mempool congestion, which means that users have to pay more to get their transaction confirmed.

Bitcoin’s mining difficulty is expected to drop more than 5.6 percent after the next adjustment, which will give miners a breather.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin