MicroStrategy is in the news again, with the company's latest Bitcoin (BTC) purchase worth over half a billion dollars. With this latest purchase, the company now holds a whopping 444,262 BTC, which they have accumulated at a total cost of approximately $28 billion, with an average purchase price of $62,257 per BTC. This is the seventh Monday in a row that the company has bought Bitcoin.

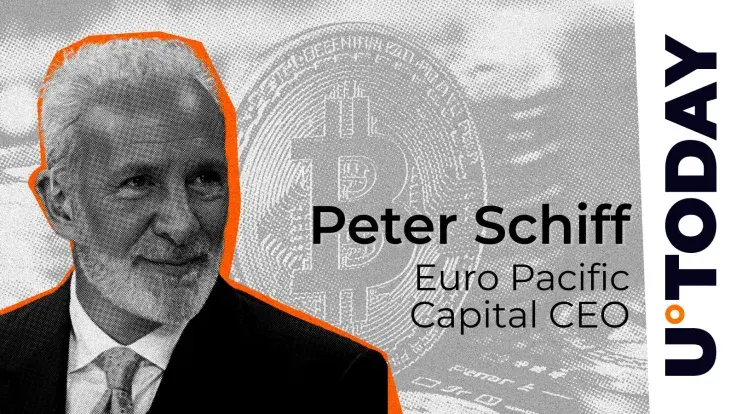

But Peter Schiff is not so sure about the strategy behind MicroStrategy's buying spree. He says they are running out of money to keep buying Bitcoin.

In a direct response to MicroStrategy CEO Michael Saylor, the financial expert pointed out that this was the smallest purchase to date, and it was also the first time that the average purchase price was higher than the current market price on the day of the announcement.

This may be a red flag in Schiff's vision, as he suggests a misalignment between the company's investments and market reality, potentially signaling a riskier strategy to keep up appearances instead of focusing on solid financial basics.

Even though Bitcoin has done really well since the beginning of the year, up over 121.8%, people are starting to question MicroStrategy's approach. Some think that the company is using a cycle of leveraging capital to fund its Bitcoin purchases by issuing convertible and corporate bonds, securing lines of credit and selling stock.

The concern is that this could be risky. A lot of MicroStrategy's money is tied up in Bitcoin, so if the price of BTC drops significantly, it could wreak havoc on the company's finances and trigger a sell-off of the cryptocurrency itself.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov