Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

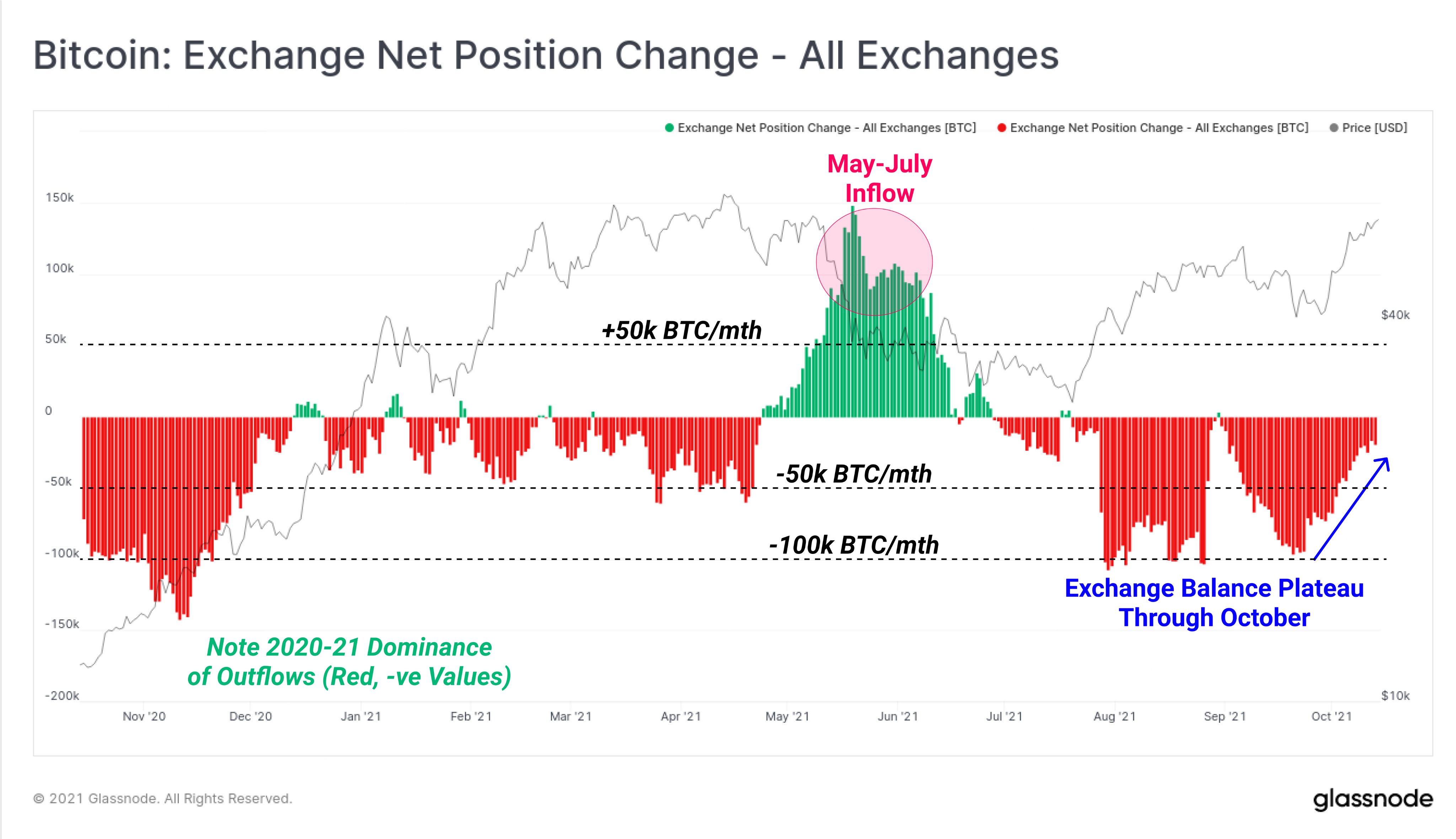

With the rapid price increase of Bitcoin, exchange inflows reach a plateau after achieving 100,000 Bitcoin outflows from exchanges, according to Glassnode.

The exchange inflows and outflows are the first indications of the presence or absence of selling pressure on the market. With continuous outflows from the exchange, Bitcoin has been actively growing due to the absence of selling volumes coming from exchanges.

With prices reaching the previous ATH, more traders are becoming concerned and are willing to take profits. The highest inflow rates were previously present in May, prior to the massive Bitcoin sell-off that led to the 40% correction on the market.

Exchange inflows can also be used to track the overall sentiment on the market. With low inflow rates, traders determine whether market participants are holding funds in their wallets or are looking to spend them. While funds remain on exchanges, investors are more likely to sell once the price reaches their target.

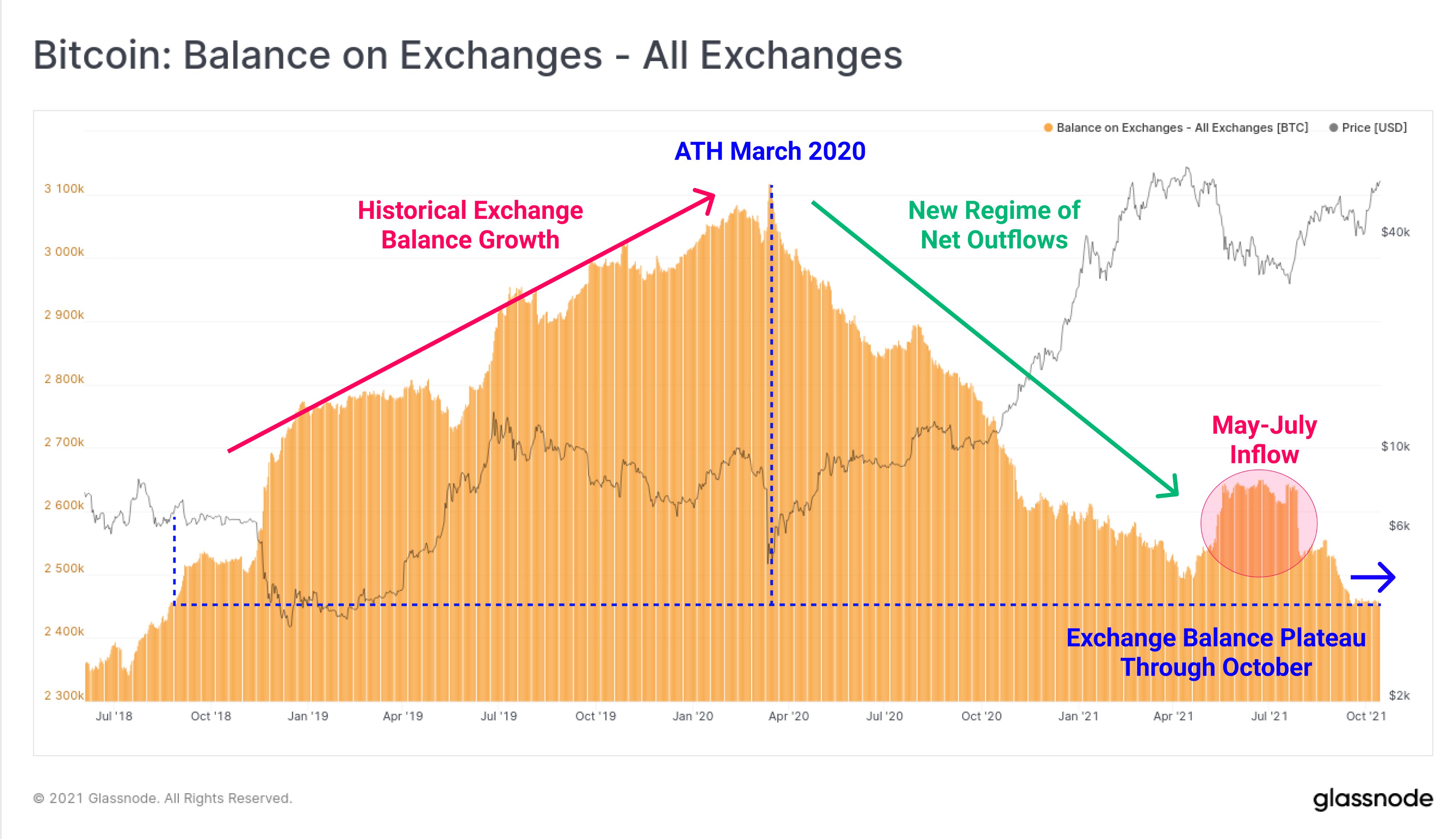

As mentioned previously, the increased inflow rates are local, and the overall trend remains negative, with the funds held by exchanges moving either down or in a range. Total exchange balances remain at 2.45 BTC, which are currently at August 2018 levels. At the previous ATH, the number of funds stayed at 3.11 million BTC. With the current outflow rate, the exchanges lost 21% of the ATH balance.

At press time, Bitcoin is trading at $57,610, previously testing the $59,000 zone. But due to the presence of a large number of sell orders, the price swiftly retraced back under $58,000.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin