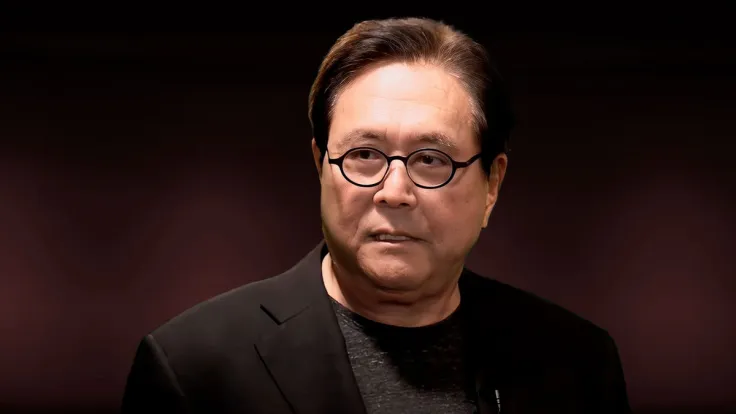

Best-selling author Robert Kiyosaki, known for his hit book "Rich Dad Poor Dad," has sounded a call of caution for investors. In a recent tweet, Kiyosaki issued a stark warning, urging people to consider moving their funds away from traditional banks.

In a recent tweet, Kiyosaki sounded the alarm bells, pointing to a conversation he had during a podcast with journalist Dr. Nomi Prins, who has delivered a simple yet impactful message: "Get money out of banks."

Kiyosaki's concern stems from the alarming Prins' revelation that the FDIC is monitoring over 725 banks, hinting at potential instability within the banking sector.

Three whales of Kiyosaki

Although Kiyosaki has long predicted the collapse of the markets, his prescription for how to survive turbulent times remains the same. The writer maintains that there are three assets that are vital during uneasy economic periods: gold, silver and Bitcoin (BTC). He asserts that if traditional markets take a downturn, these assets could witness significant upswings.

Moreover, he anticipates that Bitcoin could reach $120,000 within the next year and potentially skyrocket to an astonishing $500,000 per BTC by 2025. In the event of global economic turmoil, the author even envisions Bitcoin surging to unprecedented heights, possibly reaching $1 million.

Kiyosaki's forecasts are closely tied to his growing apprehension about the extensive money printing undertaken by the U.S. Fed, which raises pressing questions about the stability of traditional currencies, particularly the U.S. dollar.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov