Pennsylvania State University and Truflation have initiated an innovative research partnership with the goal of developing substitute metrics that provide a more accurate picture of housing inflation in the U.S.

A critical economic indicator that impacts everyone from individuals to businesses to policymakers is inflation, particularly in the housing sector. The standard techniques for calculating inflation have been to use traditional instruments like the Personal Consumption Expenditure Price Index (PCE) and the Consumer Price Index (CPI).

But these traditional measures frequently fall short of adequately capturing the nuances of housing inflation. Given these difficulties, a sizable amount of household spending is allocated to shelter costs, which comprise housing expenses and account for a sizable portion of the PCE and CPI indexes.

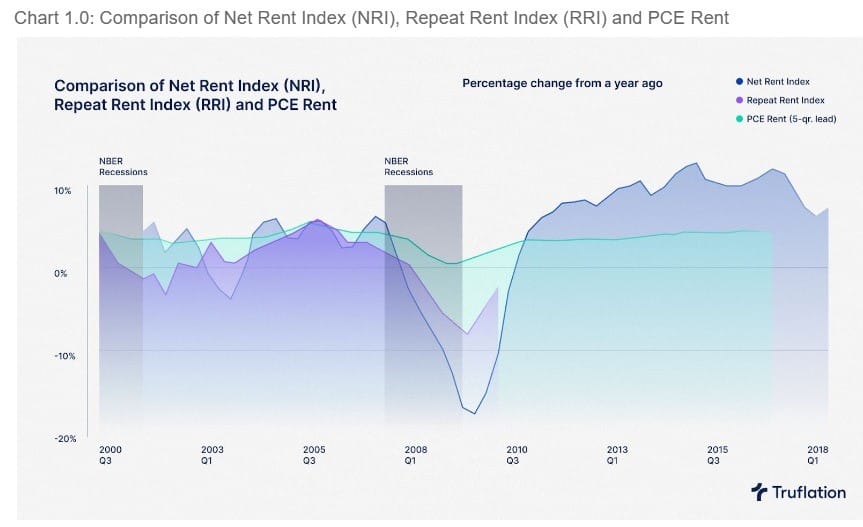

Existing techniques for calculating housing inflation have shortcomings and irregularities despite their significance. For instance, Truflation's housing index has shown a slower rate of growth in recent years despite the CPI's consistent display of rising housing costs. This disparity raises doubts about the ability of conventional inflation metrics to accurately reflect the true dynamics of the housing market.

Two new inflation indices, the Truflation Index and the ACY Inflation Index developed by Pennsylvania State University researchers Ambrose and Yoshida, are introduced by the collaboration to address these shortcomings. The goal of these metrics is to provide a more realistic image of housing inflation by taking into account a greater number of variables, including mortgage rates, property taxes and household maintenance costs.

The new indices offer a more complete picture of the inflationary pressures on the housing market by incorporating these extra variables. The methodology used by Truflation to calculate housing inflation is based on sophisticated statistical modeling and solid data analysis. The study makes use of a number of data sources such as household budget allocations, publicly available spending information and analysis from the Personal Inflation Calculator at Truflation.

Each year, the components of these indexes undergo reweighting to guarantee their continued relevance and accuracy in representing current trends in housing inflation. For many stakeholders it is essential to measure housing inflation accurately. To maintain equitable taxation and social assistance, federal policymakers utilize inflation data such as the CPI to modify entitlement programs and tax brackets.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov