Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

BTC halving breakdown

Blockchain mining involves maintaining a consistent, up-to-date and immutable record of transactions, carried out by miners. These miners are rewarded with newly created coins for their efforts. Satoshi Nakamoto programmed Bitcoin so that every 210,000 completed blocks, the reward for miners is halved.

Expected around April 17, 2024, the fourth halving will cut miner rewards from 6.25 BTC to 3.175 BTC at block height 840,000. There will be 32 halvings in total, with 29 more anticipated until year 2140 when new BTC creation ends.

Ultimately, the total supply of Bitcoin is capped at 21 million coins, leaving less than 2 million yet to be created. Currently, around 900 Bitcoins are mined daily worldwide, serving as rewards for miners who validate and secure the network, according to data from IntoTheBlock.

The Bitcoin halving impacts the price via supply and demand dynamics, with fewer coins available leading to potential price increases. Reducing selling pressure, halving may have a heightened effect in the upcoming event due to potential demand increases. Historically, Bitcoin's value has surged within the same year as a halving event.

Overall, Bitcoin has experienced four bull runs coinciding with halving events, with Bitcoin topping $1,000 following the 2012 halving and $20,000 after the 2016 event. The most recent halving occurred in mid-May 2020, preceding a significant bull cycle that peaked in November 2021 at an all-time high of $69,000.

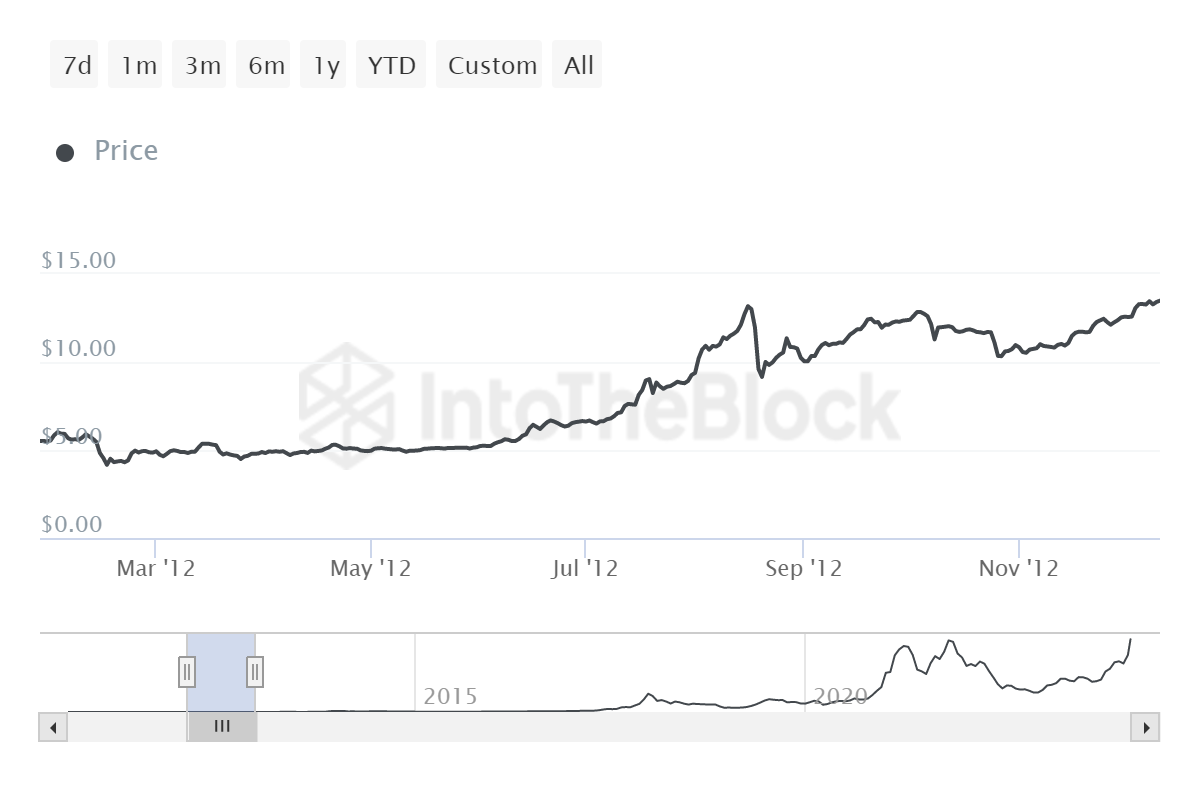

First halving, 2012

In 2012, Bitcoin was relatively unknown outside of cypherpunk circles. However, one year prior to the first halving, Bitcoin's value had already skyrocketed almost fourfold.

The inaugural Bitcoin halving occurred at block 210,000, reducing the block reward from 50 BTC to 25 BTC. This event generated tension among crypto investors, fearing it might discourage miners and coincided with Bitcoin's rise to mainstream attention.

Just a month before the 2012 halving, BTC was at $10.26, with no significant price movements up until the event. One month after the halving, the average price was $13.42.

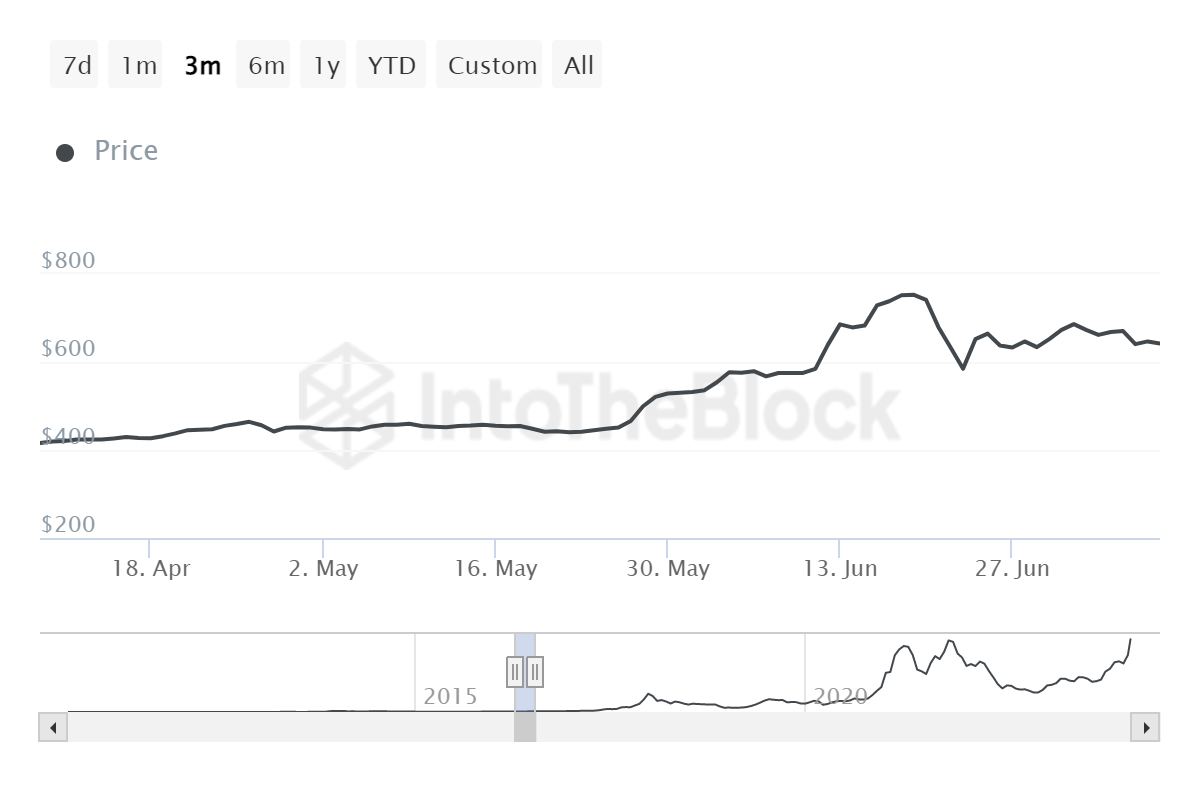

Second halving, 2016

The second halving took place on July 9, 2016, and reduced the block reward from 25 BTC to 12.5 BTC, propelling Bitcoin and crypto into the limelight amid media scrutiny, coinciding with the altcoin and ICO frenzy, which saw its fair share of scams.

On June 9, 2016, BTC was priced at $583.11 and grew up to $597.5 following the event.

Later movements were far more significant. Despite a subsequent drop from $1,200 to near $200 in 2015, the halving event saw Bitcoin's price rise from around $650 to nearly $19,000 before crashing to under $4,000.

Prices were significantly higher than the first halving but still far from the subsequent years' peaks. BTC reached $766 per unit on June 16 before dropping 13.83% to $660 on the halving date. Nonetheless, by Dec. 31, 2016, Bitcoin's price had surged to $963 per unit.

The price plummeted to $670 at the time, but rose to $2,550 by July 2017. Despite traders anticipating another bull run, Bitcoin's price saw a massive surge in 2017 followed by a decline to around $3,700 by the start of 2019.

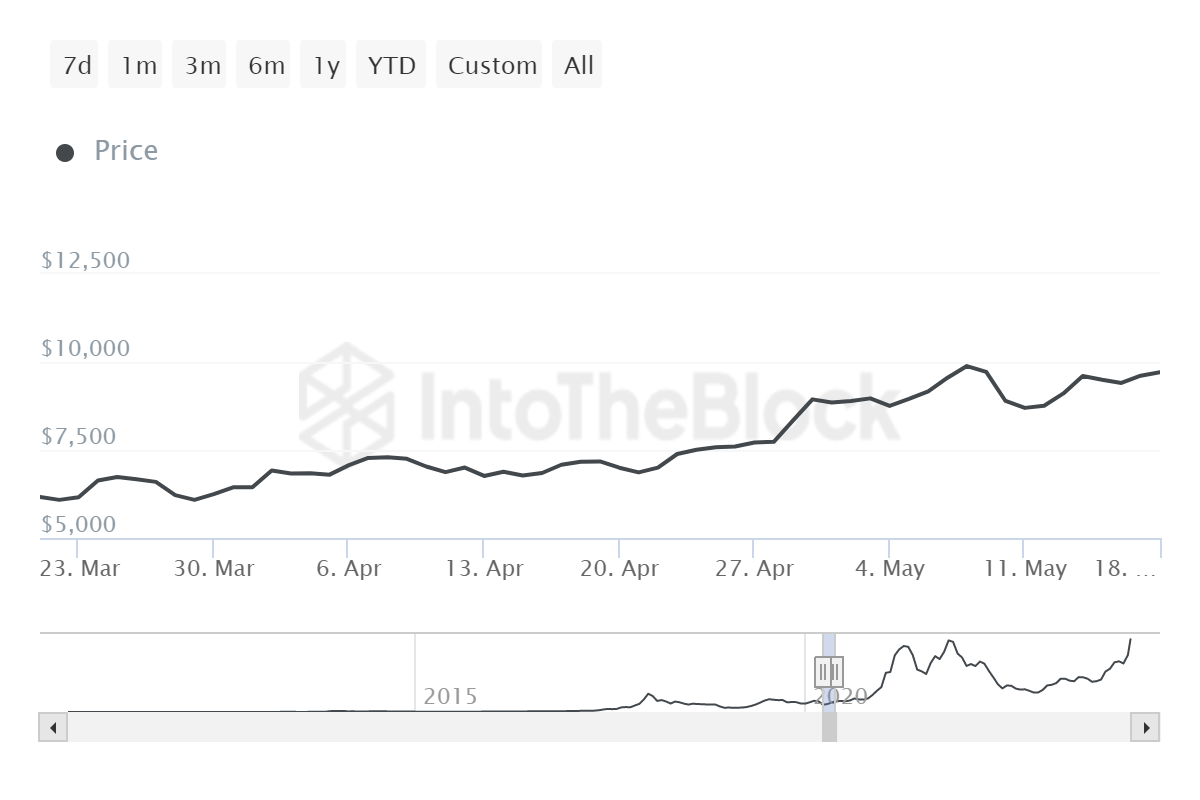

Third halving, 2020

The third halving in 2020 occurred amid the COVID-19 pandemic, yet BTC/USD patterns remained consistent. This event, at block 630,000, reduced block rewards by half to 6.25 BTC, where they will stay until the fourth halving in April 2024.

During this time, influential investors publicly endorsed Bitcoin. As institutions began exploring adoption, crypto payments became more widespread.

In the six months preceding the 2020 halving, Bitcoin experienced a 300% surge in price, mirroring similar patterns observed before previous halving events.

Ahead of the 2020 halving, Bitcoin traded at around $9,000, reaching a record high of $67,549 post-halving, then settling around $20,000 for some time.

The 2020 halving preceded Bitcoin's peak at $69,000, but the price surge did not occur immediately; in some instances, it took months for Bitcoin to reach new highs.

Following the market crash on March 11, 2020, Bitcoin experienced a significant price drop, plummeting from $7,944.05 to $4,857.31, representing a 38.85% fall, though it did not surpass the 2012 decrease.

Nonetheless, Bitcoin experienced a significant rally in late 2020, soaring from roughly $11,000 in October 2020 to approximately $60,000 by March 2021. Bitcoin closed 2020 at $29,228 per coin, marking a remarkable 302% increase for the year.

Fourth halving, April 2024

With only three Bitcoin halvings to date, drawing definitive conclusions about BTC's pre- and post-halving performance remains challenging. However, it is consistently observed that one month before each event, Bitcoin's price tends to be lower than at the time of the halving.

Date | Price 1 month prior | Price 1 month after |

Nov. 28, 2012 | $10.26 | $13.42 |

July 9, 2016 | $583.11 | $597.5 |

May 11, 2020 | $6,909.95 | $9,850 |

So far, Bitcoin's price has more than tripled since February 2023. The 2024 Bitcoin halving coincides with significant events, including the game-changing approval of a spot Bitcoin ETF in the U.S. and the Federal Reserve's likely shift toward rate cuts.

One key aspect of the upcoming halving is the proactive measures taken by miners to address revenue challenges, such as equity offerings and reserve sales. Potential adjustments in mining difficulty, influenced by changes in hashrate, could lower production costs for miners.

Furthermore, the rise of inscriptions has led to increased on-chain activity, with token collectibles generating substantial transaction fees. Additionally, the halving may occur alongside potential quantitative easing by the Federal Reserve to support economic recovery, suggesting a muted bull run.

Historical data analyzed by IntoTheBlock suggests an upward price trend after halving events, while the current cycle shows prices rallying earlier than expected, indicating that investors may be anticipating the "halving effect" in advance.

JPMorgan's recent report suggests the possibility of the BTC price dropping to $42,000 due to miners’ reduced rewards and higher production costs as a result of the April halving. Currently at $26,500, this cost is projected to double to $53,000 post-halving.

Conclusion

While analyzing Bitcoin halving dates provides insights, it is important to note that they do not tell the whole story. Price fluctuations are influenced by various factors, including broader market trends and shifts in cryptocurrency popularity, as seen throughout 2021.

However, Bitcoin's halving cycles typically follow a pattern of rally, correction, consolidation and eventual bull run post-halving. Despite significant price increases after each halving, there are consistent pullbacks, leading to broader market slowdowns.

Halvings typically coincide with price increases, but other factors like market sentiment and regulatory changes also influence prices, emphasizing the need for a broader perspective when analyzing market trends. Given that there have only been three Bitcoin halvings to date, drawing definitive conclusions about BTC's performance before and after these events is challenging.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov