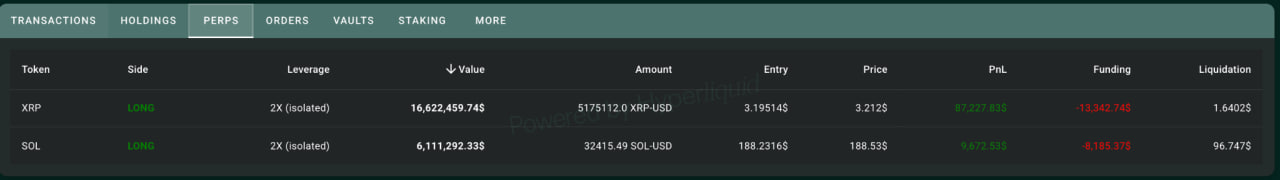

A wallet with no prior history has just opened a monster position on XRP — 5,175,112 tokens — which was placed in three entries in a row at around $3.20 on Hyperliquid. The total value of the trade is $16.62 million, with 2x isolated leverage. If XRP crashes to $1.6402, the whole pose will be liquidated.

The address now shows a total of $22.7 million, split between two leveraged perpetual positions: XRP and SOL. The XRP long position has an unrealized profit of $87,227 at current prices, while the SOL position is adding another $9,672. But the combined funding costs are already over $21,500 and eating gains.

But it's the XRP entry that's got everyone's attention. The wallet put in three orders at $3.2029, $3.2051 and $3.2061, just as the market pulled back to the mid-range. Before this, large limit orders were scattered between $3.44 and $3.45, but these didn't go through. Then it switched to market execution and entered directly.

XRP price has since stabilized just above $3.21 — close enough to the average entry price to keep the position profitable, but still below the wallet's earlier bid ceiling. The price is currently right in the middle of the Bollinger Bands for the day, and if it stays there, the timing of the whale's move might be spot on.

The liquidation zone is miles below, almost 50% down, but the amount of capital at stake makes it clear that this isn't a low-risk move. A deep retracement could wipe out the whole position, but as long as XRP stays up, this wallet is set to make the most of the next upward trend.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin