Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

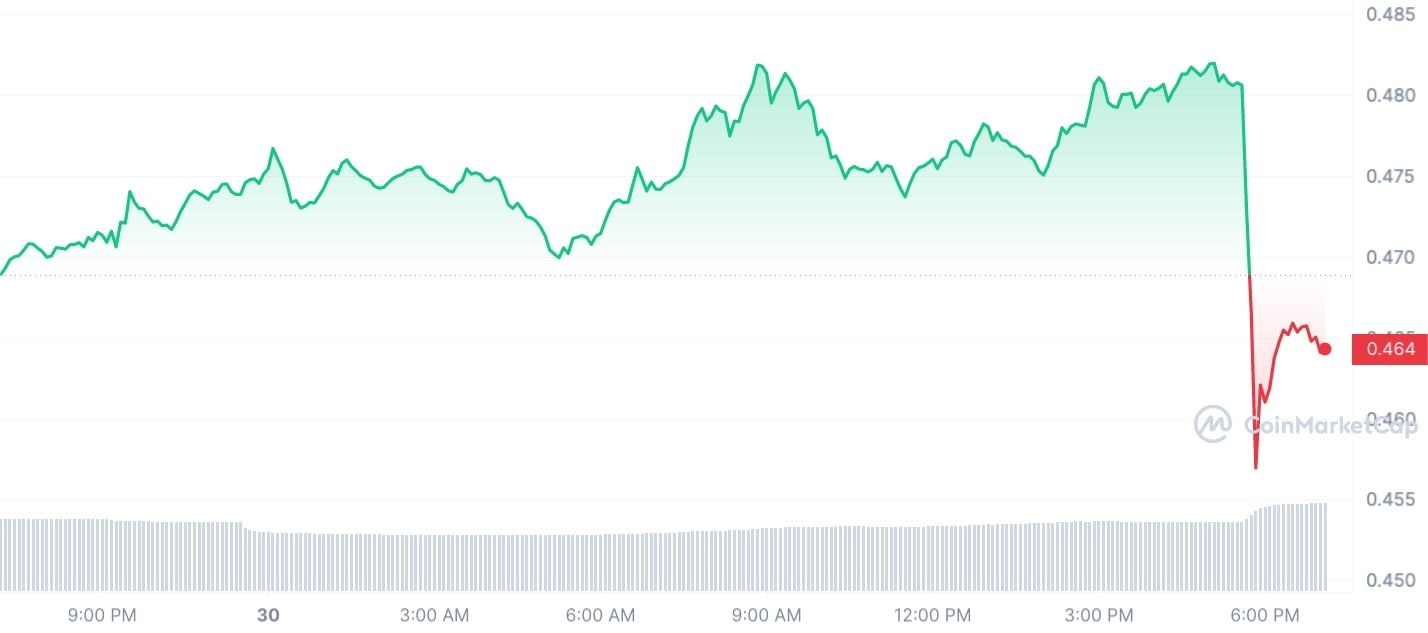

In a dramatic turn of events, the XRP token plummeted by more than 6.4% within just half an hour, sending shockwaves through the crypto market. The drop was triggered by a massive token dump of 50 million XRP, with a staggering 30 million of them being sold off in a mere five minutes.

The catalyst behind this massive sell-off was an alarming report published by the Wall Street Journal. The article revealed the Securities and Exchange Commission's claim that filings for spot Bitcoin exchange-traded funds (ETFs) are incomplete and unclear. This single headline alone managed to wipe out a staggering $56 billion from the overall market capitalization, leaving XRP severely impacted.

The Securities and Exchange Commission said a recent wave of applications filed by asset managers to launch spot bitcoin exchange-traded funds are inadequate https://t.co/EmcJIt5Qm2?from=article-links

— The Wall Street Journal (@WSJ) June 30, 2023

However, amid the chaos and panic, there may be a glimmer of hope for the crypto industry. The same article revealed that the SEC is open to considering applications for ETFs once they are finalized.

Bulls remain resilient

Despite the immediate earthquake-like impact on the market, some optimistic crypto enthusiasts remain unfazed by the sell-off. They argue that the SEC's willingness to reconsider applications for ETFs, coupled with the expressed interest of financial powerhouses such as BlackRock and Fidelity in creating crypto-related investment products, indicates a potentially bright future for the industry.

While the short-term effects of the token dump were undoubtedly felt across the market, the prospect of renewed consideration for ETF applications may serve as a catalyst for recovery. As investors navigate these uncertain times, all eyes remain on the SEC's next moves and the potential implications for the crypto market as a whole.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov