Billionaire Mark Cuban continues to debate crypto Twitter after likening the current bull run to the dot-com bubble of the late 90s.

This time, the “Shark Tank” star took aim at Ethereum’s exorbitant fees, noting that the cost of moving ETH to DeFi lending protocol Aave is “crazy expensive” while predicting that non-crypto options could replace in a recent tweet:

I don’t think people realize I try to test and use all this stuff and have for years.

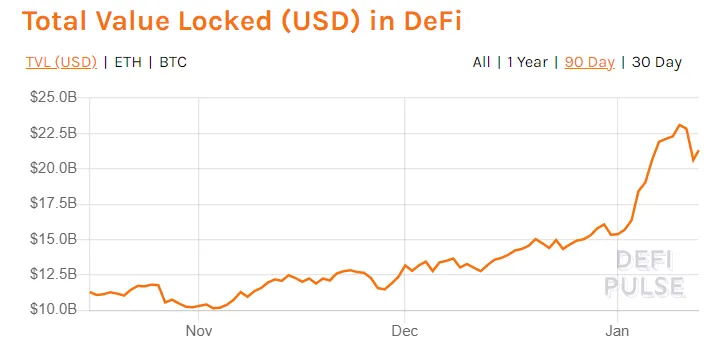

As reported by U.Today, gas fees that are necessary for processing transactions on the second-largest blockchain spiked to a new all-time high after ETH soared to its highest level since early February 2018 on Jan. 4.

Countering Cuban’s remarks, Blocktown Capital’s managing partner James Todaro noted that paying $100 in gas fees is still “far cheaper” than the fees in legacy finance.

However, the Dallas Mavericks owner is convinced that the whole system could collapse if just one element collapses:

Just remember WITH DeFi, as with all derivatives, the RISK NEVER LEAVES THE SYSTEM. One segment collapses, they all face risk of collapse.

Cuban vs. Winklevoss

After Bitcoin bull Tyler Winklevoss confronted Cuban about his comments regarding the similarities between internet stocks and crypto, the two started another war of words on Twitter.

Cuban continues to stick to his point that both Bitcoin and Ethereum are similar equities despite being two separate networks:

Wrong. They may be networks , but they require other networks and utilities to run and be mined. Those networks issue digital ownership designed to be stores of value . Just like stocks are stores of value that represent perceived ownership of the finances of the issuer.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov