Last Thanksgiving, Bitcoin was in the middle of a bull run that would result in a record high of $19,511 just before Christmas. Now, Bitcoin is worth just $3,752.

If you bought Bitcoin and other cryptos when their prices were high, there’s a silver lining around the gray state of crypto markets now: any losses you take this year could place you in a lower tax bracket. What’s more, claiming those losses is easier than you might assume.

Read on to find out everything you need to know about how to file your crypto losses.

Filing Your Crypto Taxes 101: How Does it Work?

For the purposes of taxation, the US and most other governments consider cryptocurrencies to be assets. This means that whenever you trade cryptocurrency, the transaction falls into one of two categories: a capital gain or a capital loss.

-

Capital gain. A capital gain occurs when you sell cryptocurrency for more than the amount that you paid to purchase it.

-

Capital loss. If you sell cryptocurrency for less than the amount that you paid for it, this is considered to be a capital loss.

Advertisement

You have to sell or buy an asset to trigger a taxable gain or loss. Once you decide to make a move, tax authorities consider the loss to be “realized.” If your loss is great enough, you may be able to use it to enter a lower tax bracket.

Deducting Your Crypto Losses

One of the biggest benefits of claiming a loss is that you can offset income gained from other sources.

In the US, the IRS lets you deduct up to $3,000 worth of net capital losses each year from the amount of money you’ve earned at your day job. If the amount you lost was greater than $3,000, you can get another deduction of up to $3,000 when you file your taxes next year.

If you currently make just over $50,000 per year at your job, that $3,000 cryptocurrency loss could place you in a lower tax bracket. This could result in thousands of dollars of tax savings.

What’s more, if you’ve earned some income through stocks or through the sale of property, there’s no limit to the amount you can deduct from those revenues.

Examples

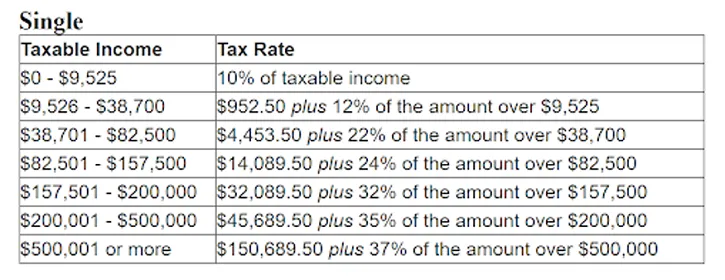

Here’s a look at the 2018 tax brackets for single individuals.

If your crypto tax loss puts you below the $38,700 mark, you’d only have to pay $952.50 plus 12% of any amount over $9,525. But if you made $38,701 or more, you’d have to pay over four times as much in taxes, plus 22% of any amount over $38,700.

In other words, if you fail to deduct your crypto losses and you fall into the third bracket as a result, you’d have to pay at least $4,453.50 to the IRS. But if you do file your losses and make it into bracket two, you’d pay just $952.50.

Total tax savings: $3,501.50.

If you’re married and filing jointly or widowed, moving into a lower tax bracket can result in even more tax savings. If you made $77,402 in 2018, you’d have to pay the IRS $8,907 and change.

Dropping down to the $19,051-$77,400 tax bracket by filing a crypto loss would save you $7,002.

How Does Crypto Mining Income Affect Taxes?

In addition to cryptocurrency traders, cryptocurrency miners can use deductions to reach lower tax brackets.

A notice that the IRS published in March of 2014 provides some relevant details:

“...when a taxpayer successfully “mines” virtual currency, the fair market value of the virtual currency as of the date of receipt is includible in gross income.”

If the value of the cryptocurrency you mined decreased and you decide to sell it, then that would mean that you have triggered a capital loss. You can report this loss in the same way that you would if you bought and then sold your coins through an exchange.

IRS analysts told CNBC that electricity costs and other expenses may be written off as well.

Here’s Where It Gets Complicated...

Figuring out how much you’ve made or lost can be a headache, particularly if you haven’t been keeping track of your purchases or if you placed a huge amount of trade orders last year.

Sorting out how much you lost or earned requires access to historical pricing data. Without that historical data, you won’t be able to determine what the price of your crypto asset was when you bought and sold it.

Cryptocurrency Tax Tools

Fortunately, there is software available that can crunch all your crypto tax data for you.

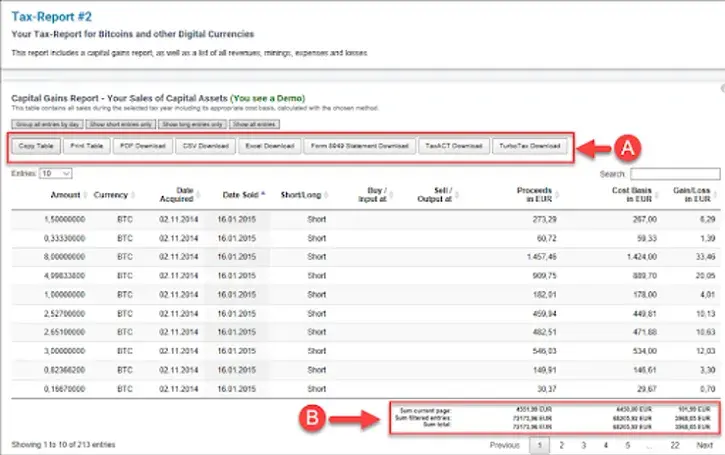

The tool depicted below, called CoinTracking.info, can import your transactions from all your cryptocurrency wallets and exchanges. The interface walks you through how to do the imports.

At the end of the import process, you can download IRS form 8949. This is the form you need to submit to report your loss.

Other download options include CSV, TaxACT and TurboTax.

Watch Out for Self-proclaimed “Crypto Accountants”

If you use a crypto tax calculator to do your own taxes, filing your taxes is a straightforward process. All you have to do is take the total from IRS form 8949 and transfer that to IRS form 1040 Schedule D.

In fact, most CPAs that work with crypto traders use CoinTracking and other publicly available software to determine what their clients owe. These tools are not difficult to use. Many have free trials, which let you see how they work for yourself before you commit.

Conclusion

If you lost money in crypto markets last year, you may be able to offset some-- or perhaps even all-- of those losses at tax time. Reporting your capital losses might help you move to a lower tax bracket. If your deductions qualify you for a lower bracket, filing them could save you thousands of dollars when you submit your taxes this year.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov