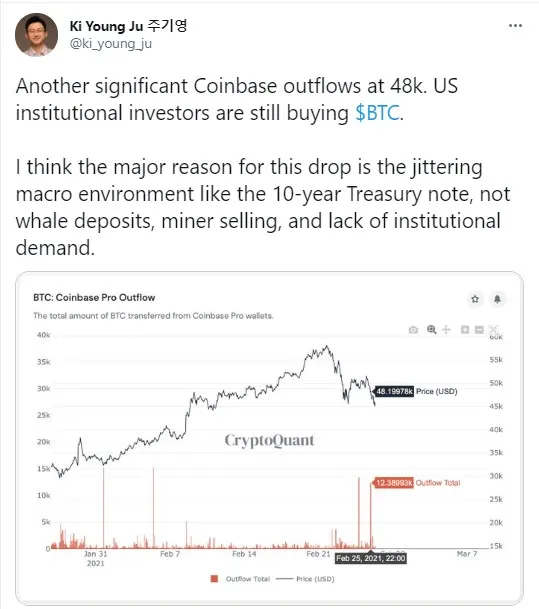

In a recent tweet, CryptoQuant analytics company chief, Ki Young Ju, spread the word that on Friday, a whopping $13,000 Bitcoin was acquired and moved from the largest US digital exchange Coinbase.

The Bitcoins were purchased by US financial institutions, who are accumulating Bitcoin as it is trading in a correction, according to Ju. That Bitcoin was worth $624 million and acquired at $48,000 per coin.

US institutions acquire Bitcoin as buying pressure grows

13,000 Bitcoins were acquired on Friday, as per the CryptoQuant CEO, when Bitcoin managed to rise from the $45,000 zone to a peak of $48,000 and then went back to $45,000, according to the data from CoinMarketCap.

At the time of writing, Bitcoin is changing hands at $46,613. The purchased Bitcoin was moved from Coinbase to cold storage custodial wallets.

While the crypto locomotive is undergoing a correction, hedge funds keep acquiring it to lock it away.

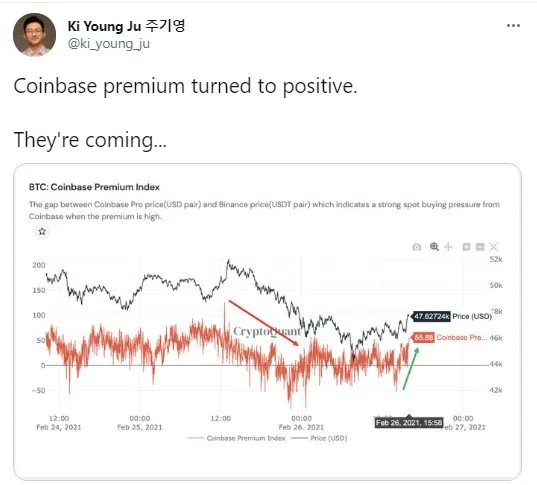

Besides, Ki Young Ju posted a tweet which shows a rise of Coinbase premium. This demonstrates a strong spot buying pressure on Bitcoin.

Coinbase files for an IPO

As reported by U.Today earlier this week, Coinbase trading platform had filed for an IPO with the US regulator Securities and Exchange Commission.

The latter had sued Coinbase earlier this year for permitting XRP trading (“unregistered securities”, according to the regulator) and for collecting fees on those trades.

Coinbase’s shares will be traded on Nasdaq under the COIN ticker. The company has been evaluated at more than $100 billion.

Coinbase had also revealed that it had been holding Bitcoin and other cryptocurrencies on its balance sheet since its foundation back in 2012.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin