Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bear markets represent an integral part of economic cycles in every segment: cryptocurrencies, stocks, commodities, ETFs, real estate, bonds and so on. Moreover, to some extent, bear markets affect the most sophisticated economic systems, such as regional and national economies.

Thus, having a detailed, well-elaborated and balanced strategy for the upcoming bear market is a sine qua non for a proper trader and investor.

What is a bear market and why is it inevitable?

A bear market is a phase of the market cycle in which the capitalization of this or that asset declines steadily.

Bull markets and bear markets

“Bulls” and “bears” represent two groups of traders in every market. “Bulls” are interested in price increases and opening “long positions” (or “longs”), while “bears” are expecting asset prices to drop.

On the stock market, analysts register a bear market when a stock loses 20% of its price. The most recent example of a short-term bear market is the Dow Jones dropdown amid the 2020 market recession.

Bear markers are natural for economics: they allow oversold assets to experience a healthy price correction to avoid a more dangerous bubble. At the same time, bear markets are painful, in particular, when market sentiment changes rapidly.

Signs of bear market coming

Bear markets begin when an asset price grows too fast. That is why the signs of incoming bear markets are the same for many assets:

- Enormous hype around some product (TSLA stocks, Bitcoin, crude oil futures and so on);

- Inflow of newbie retail investors to markets (crypto in Q4, 2017);

- Price upsurge loses correlation with value of underlying product (“Gamestop drama”);

- Money flows from spot trading modules to derivatives segment;

How do you protect your assets in a bear market?

Brutal bear markets can erase all gains obtained by a certain trader in a bullish phase. That is why it is crucial to prepare a strategy of asset protection before a bear market is confirmed.

Portfolio rebalancing

When a bear market is coming, experienced traders reduce the share of more volatile assets in their portfolios (cryptocurrencies, penny stocks), putting money into a less volatile one (cash, commodities). As a result, the “Risk-Reward” ratio is reduced: all in all, portfolios become less aggressive.

At the same time, in this case, the net value of the portfolio becomes exposed to surging inflation.

Longs and shorts

Then, traders who use leverage instruments in their activity should reduce the share of long positions and increase the number of shorts. From a mathematical standpoint, in a bear market, a short position has more chances to be closed with profits.

However, the manipulator can easily drain the liquidity of “shortists,” breaking the declining trend on low time frames.

Stablecoins

Cryptocurrency traders should move the significant share of their liquidity to stablecoins. Pegged to fiat currencies, stablecoins can be easily utilized as a perfect hedge against bear market losses and volatility spikes.

Introducing SimpleFX: fast and secure app for different assets

SimpleFX is a one-for-all ecosystem for cryptocurrencies, stocks and commodities trading that can help traders survive a painful bear market with minimal losses and even increase capital “when blood is in the streets.”

SimpleFX for crypto

Unlike the majority of platforms that support different types of assets, SimpleFX released a feature-rich toolkit for cryptocurrencies trading. It supports CFD trading with a variety of digital assets: cryptocurrency majors (Bitcoin, Ethereum, Litecoin), DeFi coins (Yearn.Finance, Chainlink), privacy cryptos (Monero, ZCash), mainstream proof-of-stake (PoS) coins (Tezos, Polkadot, Eos) and so on.

Recently, it enabled Bitcoin Lightning Payments. Bitcoin’s Lightning Network (LN) is a second-layer protocol that allows the first cryptocurrency to scale. At its core, it is a network of interconnected channels that allows Bitcoin transfers between accounts without sending full transactional data to Bitcoin mainnet.

Ethereum 2.0’s staking dashboard is one more killer feature of SimpleFX. Starting from 2022-2023, Ethereum (ETH) will replace its current proof-of-work (PoW) consensus by a proof-of-stake (PoS) one. As such, its network’s integrity will be protected by stakers, not by miners.

During the ongoing stage of this transition (Beacon Chain), all Ethers of stakers are locked into a specific smart contract, i.e., “Deposit Contract.” By press time, more than $28 billion in Ethereum equivalent is locked in this contract.

SimpleFX designed a module to advance Ethereum 2.0 staking: even crypto newbies with zero expertise can lock their Ethers in favor of validators. As Ethereum is among the most stable mainstream cryptocurrencies, staking ETH with SimpleFX will be a smart bet in the upcoming bear market.

For their staking activity, all Ethereum enthusiasts onboarded by SimpleFX will receive periodic payouts, i.e., staking rewards. SimpleFX allows its customers to participate in the largest proof-of-stake (PoS) network with no special equipment and software.

SimpleFX for stocks

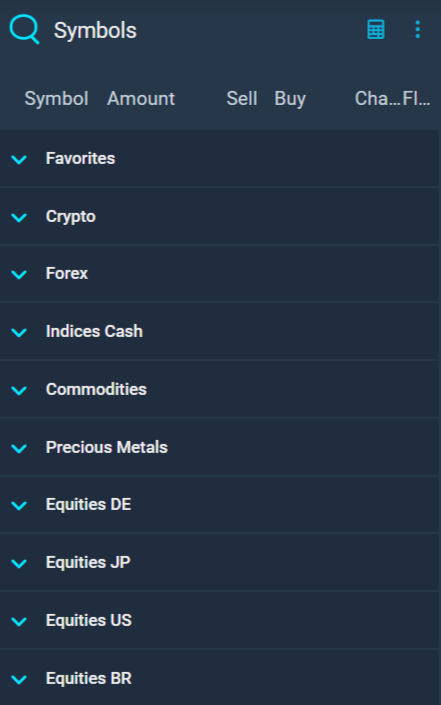

Seasoned and newbie stock traders will enjoy the SimpleFX dashboard for equities. To ease browsing through dozens of assets, SimpleFX organized equities tickers by country of origin.

In a couple of clicks, traders can access the top equities of Germany, Japan, United States, Brazil, Sweden, France, Turkey and the United Kingdom. All markets are accessible during local office hours.

Also, Simple FX listed a number of currencies to be traded in the ForEx segment. All major global currencies, such as U.S. Dollars, Euros, Japanese Yen, Chinese Renminbi, Singapore Dollars, Russian Rubles and Turkish Lira are available on SimpleFX against each other.

SimpleFX for commodities

Commodities and precious metals are another two types of assets listed by SimpleFX. Users can benefit from the price swings of Oil, Gold (XAU) and Silver (XAG) in either direction.

Cash indices are offered to traders interested in exposure to the integral economic activity indicators of various countries and regions’ economic activity.

Bottom line

Crypto, stocks and indices trading platform SimpleFX created an environment for easy and high-profit trading. It supports numerous assets of all types.

SimpleFX is a first-ever multi-asset trading ecosystem that seamlessly supports Bitcoin Lightning Network payments. Also, it enabled staking of ETH in Ethereum 2.0 consensus.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin