Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a significant shake-up for the crypto market, a substantial Bitcoin transfer totaling 7,481 BTC, equivalent to $497.14 million, was unexpectedly deposited into a hot Coinbase International wallet today. The transfer, detected by Whale Alert, originated from an undisclosed wallet labeled "12BKk."

This sizable influx of Bitcoin has prompted cautious reactions within the crypto community. Historically, transfers of this magnitude to exchanges are often interpreted as indicators of bearish sentiment, suggesting that large holders, or "whales," may be seeking to liquidate their assets. Conversely, withdrawals from exchanges typically signal bullish sentiment, implying that whales are accumulating cryptocurrency.

Bitcoin (BTC) price outlook

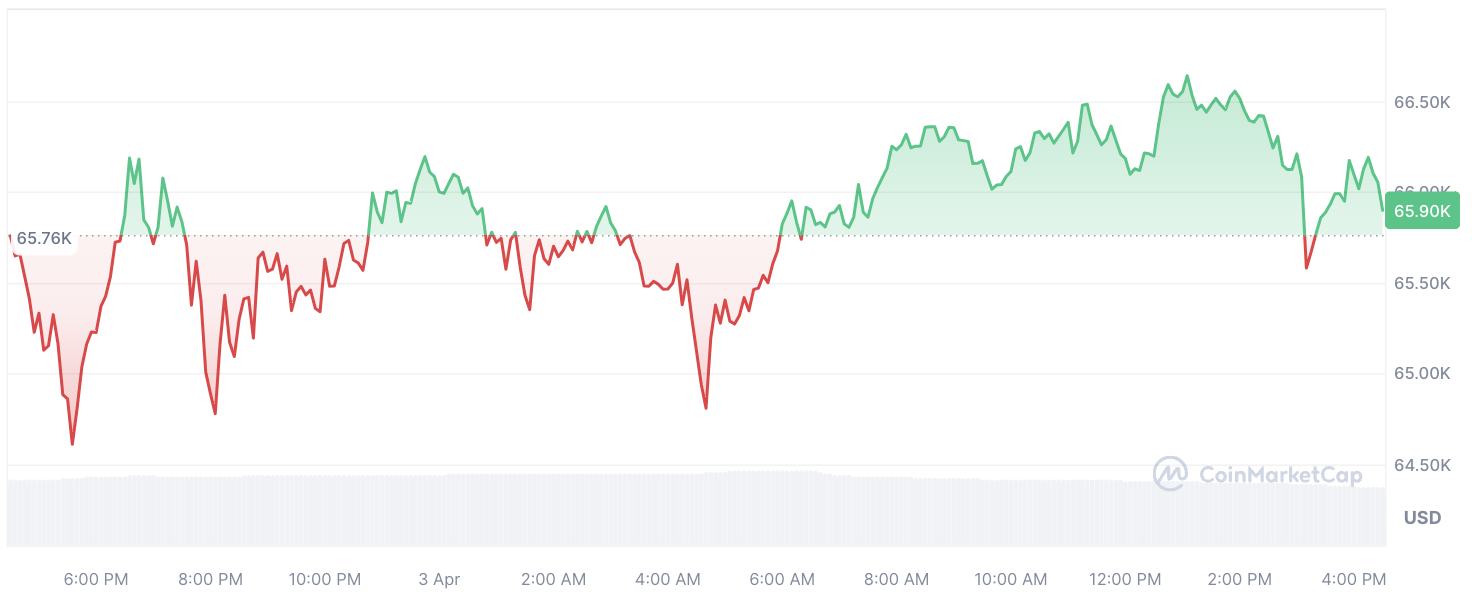

The timing of this transfer is noteworthy, occurring amid recent volatility in Bitcoin's price. Earlier this week, the cryptocurrency experienced a notable decline from $71,300 to $64,500, representing a 9.6% decrease over two days. Prior to the transfer, Bitcoin's price rebounded by 3.2%, surpassing the $66,000 mark.

Nevertheless, the quotes of BTC briefly dipped by 1.41% in the aftermath of the transfer before stabilizing.

The market's response to this significant transfer raises questions about its potential impact. Whether the subsequent price fluctuation was directly influenced by the transfer itself or by market participants' reactions remains uncertain.

Nonetheless, the event underscores the market's sensitivity to the actions of major players and highlights the importance of monitoring such developments, especially amid ongoing fear, uncertainty and doubt in the crypto space.

Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun