Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In simple terms, cryptocurrency market capitalization is the total value of all virtual currency in circulation. But what if we dig a little deeper? Take, for example, Bitcoin – the most powerful cryptocurrency. It’s known that not all BTC that are taken into account in capitalization are really available. Many coins are lost forever along with burnt disks, forgotten passwords and incorrect sending addresses, and the number of such is estimated in the millions – a significant looming error. And what about the factors affecting capitalization? We propose to talk about all of this.

How to calculate a cryptocurrency’s market capitalization?

Let's start with the simplest topic – how to calculate cryptocurrency’s capitalization. To do this, you need to multiply the total number of coins emitted by their value. In the case of Bitcoin, the capitalization calculation at the time of writing this article would look like this:

C = $5322 (price per BTC) * 17659437 (circulating supply) = $93.98 bln

Usually, the cryptocurrency’s price in the market is calculated in a pair with the US dollar. The formula is simple: it already indicates the number of assets in circulation. But, to be fair, we note that an unknown part of tokens is lost. Therefore, it is best to take the proposed numbers based on faith.

If you’re too lazy to open the calculator, there is an easier way to check the capitalization of the market in general and each cryptocurrency in particular – these are sites like TradingView and Coinmarketcap. They provide complete information about the market in the form of real-time charts, and even with all the details. These are authoritative resources, the data of which can be trusted almost always. Anyway, there is no alternative.

What factors influence cryptocurrency capitalization?

Cryptocurrencies are non-fiat money, which, in most cases, are not worth anything, as they are not backed by gold or papers. That’s why the stability of such assets entirely falls on the shoulders of the people who are interested in them. Therefore, many factors can have an impact on market capitalization and cryptocurrency rates:

-

The market behavior of large players and investors

-

News background

-

Attitudes and action of regulators

-

Community interest

The total circulation in the market plays a really important role. With the beginning of the active buying of tokens, demand exceeds supply, because the attractiveness of cryptocurrency is growing, which means the price will be taken by an uptrend. The growth of capitalization continues until the players take profits. This can be followed by a correction and continued growth, or a trend reversal.

An important factor is cryptocurrency circulation in the market. Mere capitalization and token value alone are not enough to clarify the picture. After all, if the coins are actively traded, then there is interest in them. The average normal rate of circulation per day is 15-20% of the total capitalization.

Top 5 cryptocurrency capitalizations

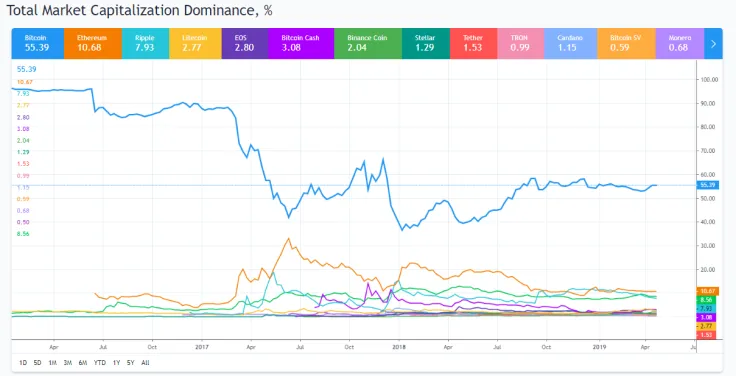

Now, the total capitalization of the cryptocurrency market is around $178 billion, but Bitcoin sets the general mood. It accounts for 52.6% of all digital assets (we calculated the capitalization of BTC earlier). The closest pursuer, if we may say so, is Ethereum (10.69%). Next, goes Ripple (8.01%), Bitcoin Cash (3.1%), EOS (2.79%) and others.

This distribution of forces suggests that hardly anything threatens the rule of Bitcoin and that it will set the general mood in the market. Speaking about the growth prospects of BTC’s capitalization in an interview with Anthony Pompliano, Mike Novogratz said:

“Gold’s got an $8 trillion market cap or a $7.5 trillion market cap. And so, we’re 100x off on that. We’re not going to get there in Bitcoin in the next year or two. But over a 20-year period, could that happen? Easily.”

Conclusion

Cryptocurrency capitalization is not as simple as it seems at first glance. Too many factors can affect it.

From 2017 to 2019, we witnessed a rise in market capitalization beyond $600 billion, its fall below $100 billion and a new upward movement. Whether it will be permanent isn’t known yet. One thing is for sure: when choosing an asset as a potential investment, you should not be guided only by capitalization index. There are a lot of influencing factors.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin