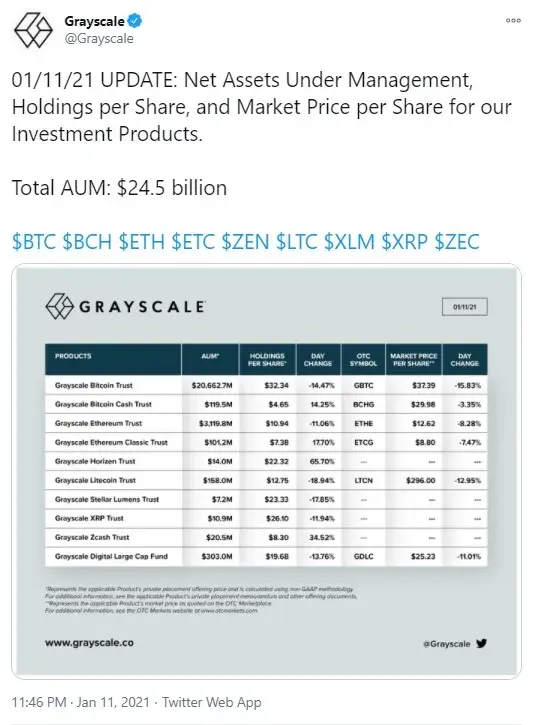

The largest crypto hedge fund, Grayscale, has posted another update, announcing that it now holds $24.5 billion worth of Bitcoin, Ethereum, XRP, Bitcoin Cash and other digital currencies.

That is four billion USD less than was announced on Jan. 8.

Grayscale's crypto holdings diminish

On Jan. 11, Grayscale published an update that it now has $24.5 billion worth of crypto assets in its storage. On Jan. 8, an update stated that the company's crypto holdings totaled $28.4 billion worth of crypto.

For comparison, Grayscale now owns a total of $20,662.70 million in Bitcoin versus $24,155 million. Ethereum holdings have dropped from $3,510.0 million to $3,119.8 million. As for XRP holdings, their volume has dropped from $12.4 million worth of XRP to $10.9 million.

Grayscale offers its customer exposure to cryptocurrencies via crypto-based products: Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETHE), XRP Trust (XRP), etc.

The worth of the company's crypto assets in management dropped as Bitcoin and other cryptocurrencies passed through a major correction on Jan. 10-11.

Bitcoin ETF approval may harm Grayscale inflows

JP Morgan analysts have recently assumed that, should a long-awaited Bitcoin ETF be approved by the SEC regulator in the U.S., this may cause outflows from the Grayscale Bitcoin Trust fund and its GBTC shares.

Bitcoin goes through a 20 percent correction

On Sunday, Jan. 10, Bitcoin posted a correction, dropping from the $41,000 level first to the $37,900 zone and then printing a bigger drop to $31,153 (on Jan. 11) after a slight recovery, losing more than 20 percent overall.

At press time, the world's biggest cryptocurrency is changing hands at $35,724.

Other major cryptocurrencies, such as Ethereum, also showed a sharp decline. The second biggest crypto, ETH, went down from $1,339 to the $925 level but it has been restored to $1,119 by now.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin