Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

During his most recent CNBC appearance, Fundstrat’s Tom Lee said that he had spotted a major risk-on signal for Bitcoin.

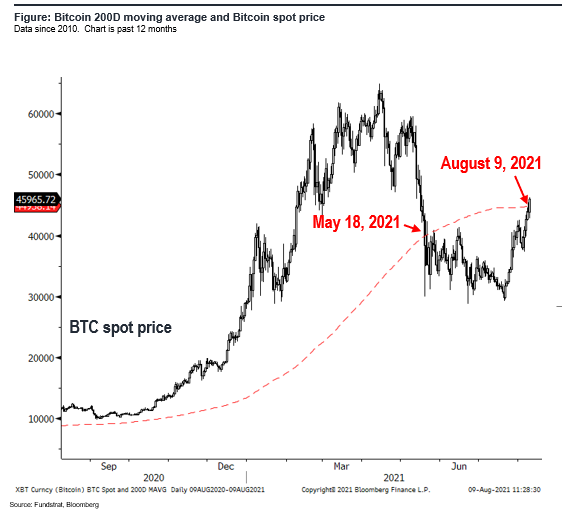

Earlier today, Bitcoin surpassed the $46,000 level for the first time since May 17.

Most importantly, the cryptocurrency managed to move above its 200-day moving average that is currently sitting at $44,982.

Lee believes that it could be the perfect spot for buying Bitcoin since the average gain is almost 180 percent. Hence, he reiterated Fundstrat’s rule #3 for cryptocurrency investing:

You always buy Bitcoin when it breaks above its 200-day moving average.

$100,000 is still in play

Lee claims that his earlier prediction about Bitcoin reaching $100,000 by the end of the year is “pretty reasonable.”

As reported by U.Today, he forecasted that the largest cryptocurrency could even touch $120,000 in 2021.

The Fundstrat analyst also noted that the flagship cryptocurrency had managed to weather regulatory and legislative assaults in both China and the U.S.

Bitcoin has been extremely resilient despite the ongoing uphill battle in Washington about the wording of a cryptocurrency provision in the infrastructure bill.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin