Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The world's largest crypto exchange, Binance, just experienced a mass exodus of Ethereum (ETH). According to a report from Whale Alert, 24,600 ETH, worth about $78.12 million in current prices, just left the exchange in a single tranche to an unknown destination.

The recipient wallet, with the address "0xe9b," that received these millions in the major altcoin is unknown to Whale Alert's database. However, Arkham's more sophisticated data identifies this address as StakeStone — a liquidity-providing protocol that operates within the Berachain ecosystem and allows Bitcoin and Ethereum to be staked in an optimized manner.

Maybe this was just a routine liquidity adjustment. Maybe not. This does not preclude it being a big whale within the Berachain and Ethereum networks who decided to withdraw $78.12 million to its own storage.

However, the ripple effect on the price of the altcoin may not be as obvious as it usually is when some major player withdraws large sums from the centralized exchange.

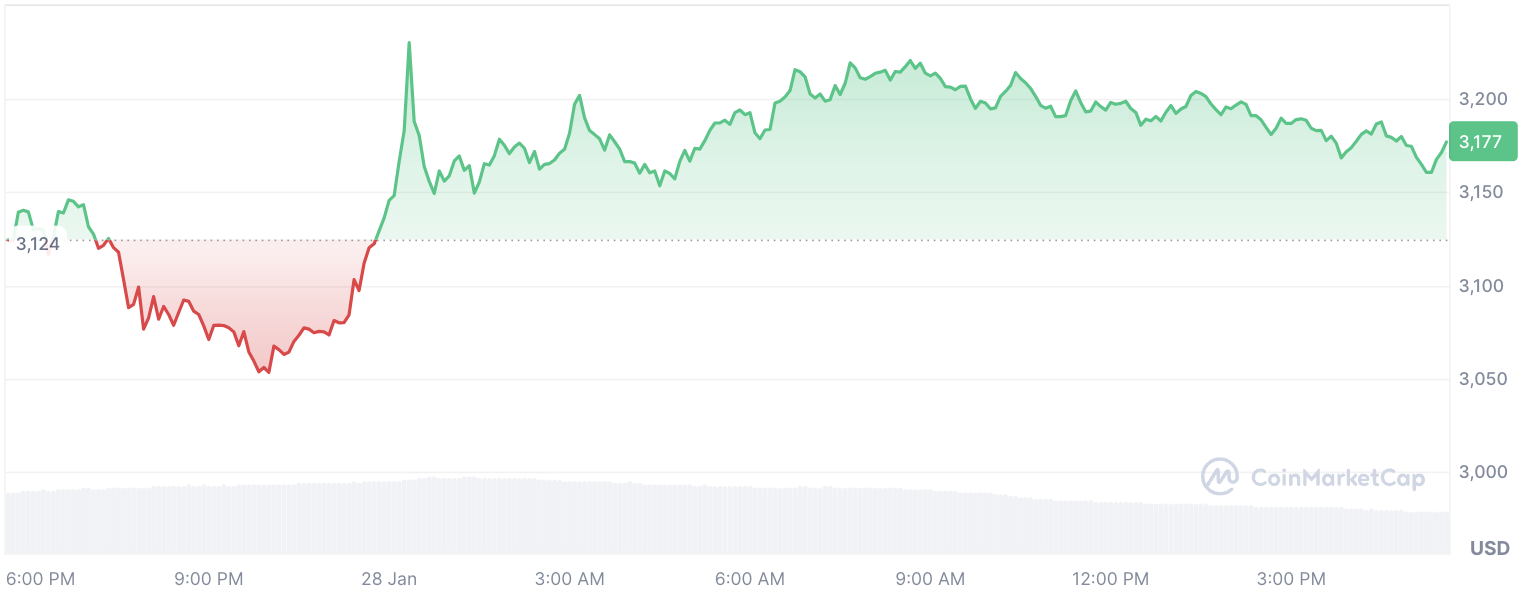

Ethereum (ETH) price reaction

The endgame remains a mystery. For Ethereum, the broader context is one of fragility. So far in 2025, ETH has struggled to hold its own, losing 5.19% of its value since the beginning of the year. The short-term picture is even less forgiving — a painful 22% drop from this month's high to this month's low.

And yet, despite this notable retreat, the impact on ETH prices has been muted. For now.

Still, the broader market uncertainty surrounding Ethereum remains, shaped by persistent macroeconomic headwinds, evolving regulatory pressures and waning risk appetite. Meanwhile, the $78 million departure adds another layer of intrigue to ETH's already complicated narrative.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin