In the first issue of its monthly Pantera Blockchain Letter, the leaders of Pantera Capital, Dan Morehead and Joey Krug, compared the ongoing crypto rally with the euphoria of 2017. A special essay by Mr. Krug evaluates Ethereum (ETH) and its role in the crypto ecosystem.

Ethereum, an internet of modern money

Mr. Krug stressed that, while Ethereum (ETH) and Bitcoin (BTC) should not be compared too carefully, Bitcoin did for digital wealth storage what Ethereum does for finance. Ethereum (ETH) powers lending/borrowing instruments, exchanges and large-scale money transfers 24/7.

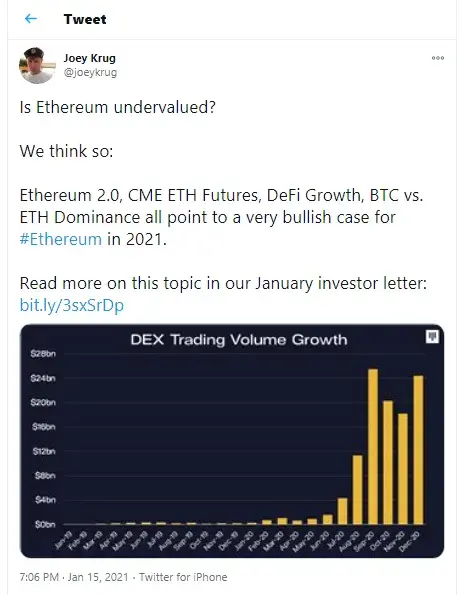

Therefore, despite being "complicated" like every breakthrough technology, Ethereum (ETH) has already found an impressive number of use cases. In 2020, both Ether-based decentralized crypto exchanges (DEXs) and lending protocols witnessed ballistic growth.

As an asset, Ethereum (ETH) serves as collateral for many DeFi protocols and as a payment unit for transactions on the Ethereum (ETH) network. Should EIP-1559 be implemented, Ethereum would be a deflationary asset.

Even so, Ethereum (ETH) is still down compared to its all-time high, while Bitcoin (BTC) has almost doubled its 2017 peak. Thus, Ethereum/Bitcoin valuation looks "historically low" for Mr. Krug.

DeFi, CME, Ethereum 2.0: more catalysts ahead

Furthermore, the near future may bring many powerful catalysts for Ethererum (ETH). Once Chicago Mercantile Exchange starts offering Ether futures, the second crypto will be "legitimized" for institutional investors.

The growth of the DeFi segment also shows no signs of decline, in terms of total vale locked, number of users and transactions, money transferred and more.

Finally, Ethereum 2.0 Phase Zero, which requires Ethereum enthusiasts to stake their holdings, significantly reduces "selling pressure": Ethereum (ETH) becomes a scarcer asset.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov