Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

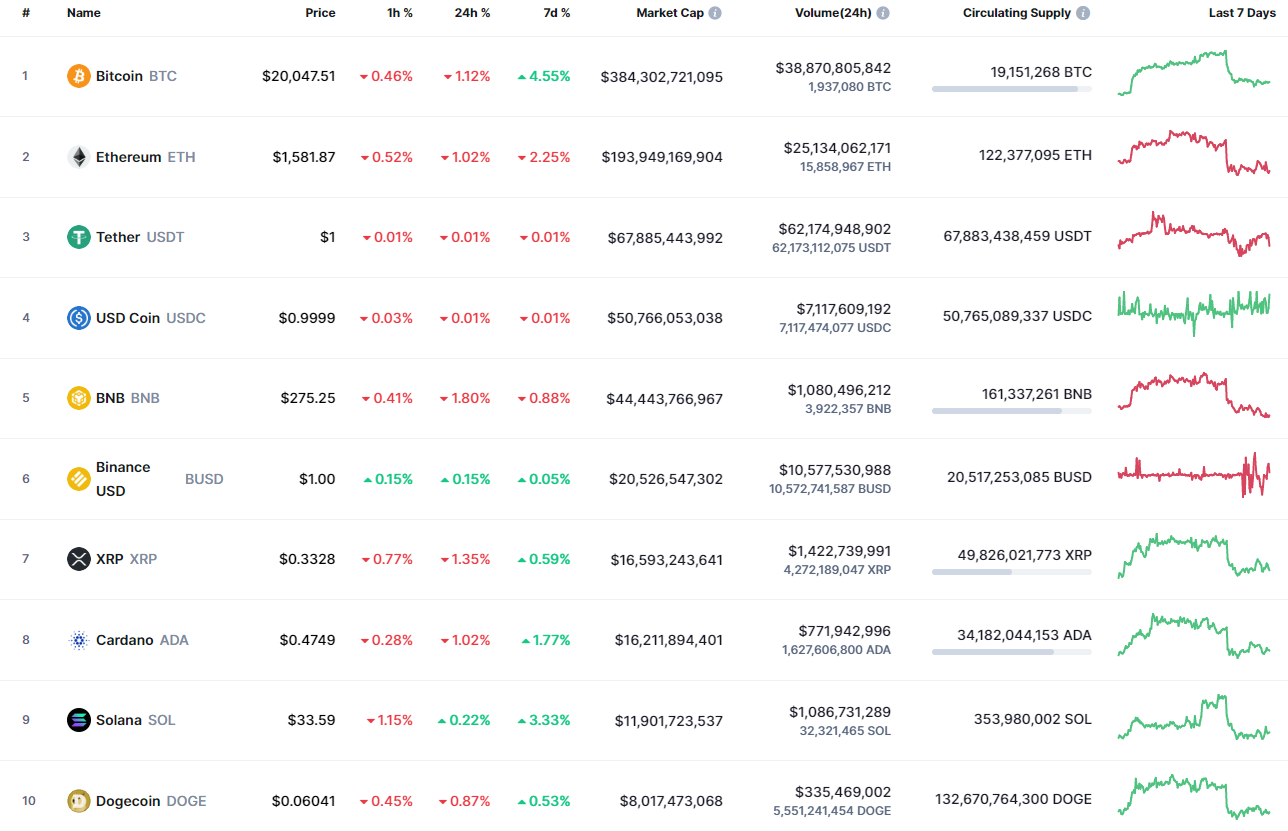

Buyers still remain under sellers' pressure as most of the coins are in the red zone.

ETH/USD

The rate of Ethereum (ETH) has declined by 0.90% after the transition to the PoS algorithm.

On the local chart, Ethereum (ETH) is being very volatile today, as the day started with sharp growth. However, buyers could not hold the gained initiative. Currently, the rate has returned to the hourly support level at $1,585, the breakout of which might cause a further drop to the $1,550 mark shortly.

On the daily time frame, bears have absorbed yesterday's growth, which means that one should not expect a fast recovery. Thus, if the candle fixes below the support level at $1,561, the fall can continue to the crucial $1,500 zone.

From the midterm point of view, the week is about to end bearish for Ethereum (ETH), as bulls could not fix above the $1,800 mark. If the situation does not change and the volume remains at the same level, one can expect the test of the support level at $1,424 within the next few days.

Ethereum is trading at $1,586 at press time.

Caroline Amosun

Caroline Amosun Tomiwabold Olajide

Tomiwabold Olajide Godfrey Benjamin

Godfrey Benjamin