Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

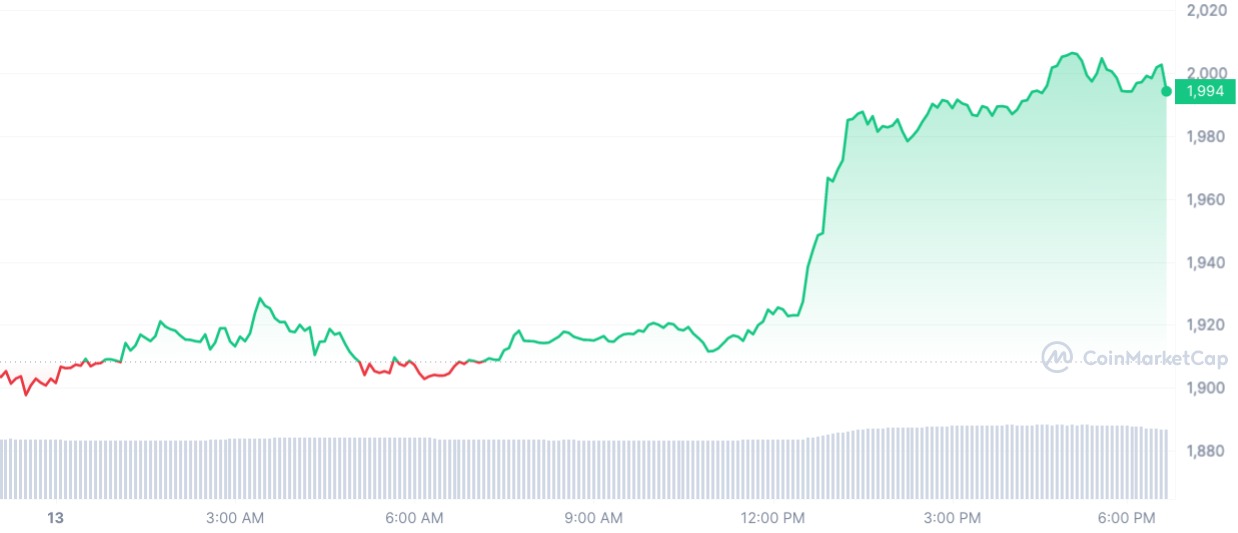

With Ethereum (ETH) hitting the $2,000 price level today, Bloomberg Intelligence senior macro strategist Mike McGlone gave his opinion on what this could mean for the cryptocurrency market. He suggests that it may signal a resumption of a bull market or the ripening of bearish bounces before a move downward.

Basing his opinion on the current economic climate, where U.S. bank deposits are declining at the fastest pace since 1971, the expert says he leans more toward the second option. He notes that it might be illogical to expect the banking crisis to end while the Fed continues to tighten policy.

From the expert's point of view, while Ethereum's rise to $2,000 may seem like a positive development, it is important to consider the broader economic context. The ongoing banking crisis and the Fed's tightening measures could hinder sustained market growth. In addition, says McGlone, Ethereum's price ceiling has held just around $2,000 since falling below $1,000 in June, shortly before the move to proof-of-stake in the fall of 2022.

In addition, McGlone suggests that if risky assets are peaking, markets may be at the very beginning of adjusting to deflation, which is normal during a recession. He notes that the Federal Reserve may never weaken with the ease with which it has done so in the past, and that prolonged deflation may be the reciprocal reaction.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin