Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

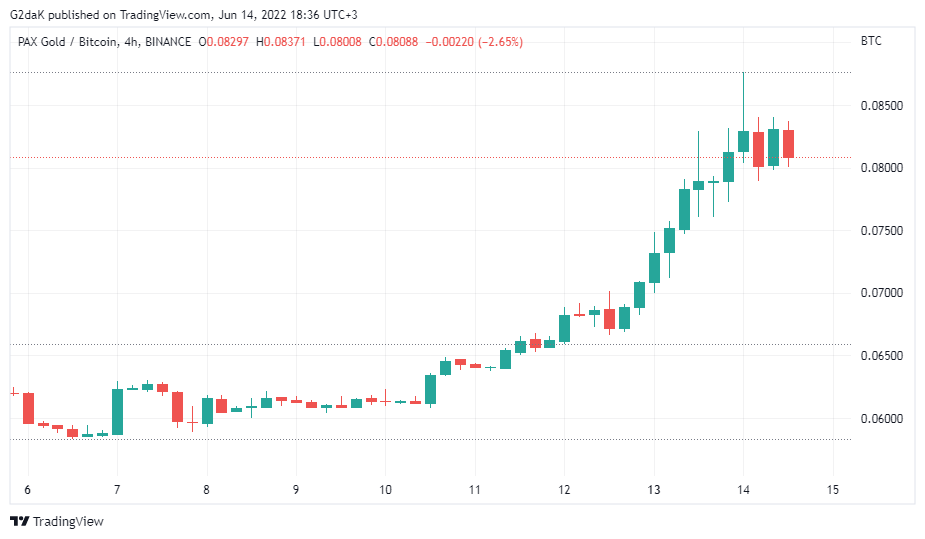

Crypto Gold contract PAXG once again overperforms Bitcoin (BTC) in the recent market bloodbath. Since the beginning of the collapse on June 7, PAXG showed an astonishing market performance, with a 50% increase against BTC at one point. Later, when the situation cooled down, its quotes fell back 7%, and its price now stays at the 0.08076 level against BTC, or $1,819 in dollar equivalent.

It is worth recalling that PAXG, issued by Paxos, is a token backed by real gold at a 1:1 ratio. Its binding to gold makes it the kind of tool that allows crypto investors to tap into gold without leaving the cryptocurrency market ecosystem.

Is gold or its crypto analog a defensive asset during a crisis?

At all times, financial markets have been dominated by the belief that gold is the asset most capable of protecting funds from inflation, at minimum, and from serious economic shocks, at maximum. However, this is not entirely true—at least as far as the last point is concerned.

Yes, when it comes to geopolitical shocks or inflation, gold is a protective asset because the economic situation of agents does not change, and they reallocate funds in favor of a "safe haven." If we talk about the situation of markets crashing, it is associated with a drop in investor income and, accordingly, with a drop in demand for precious metals.

Of course, PAXG's rise against Bitcoin is impressive at first glance. However, on the chart of PAXG to USDT, the picture does not look so beautiful anymore. Since the beginning of the same period in question, the price per token first rose from $1,836 by 3% to $1,896, but then promptly fell by 3.69% to $1,819, which is even lower than the June 7 price.

Is gold or its crypto analog a defensive asset during a crisis? The question is a creative one. The benefits of diversification from adding gold to your portfolio are obvious since the precious metal or its crypto counterpart has no direct correlation with business cycles. However, lack of correlation and negative correlation are very different things.

Gold, and PAXG in particular, is no less volatile than BTC or ETH, and it may well be losing value. So, you have to be careful in formulating a "protective asset" and clearly distinguish between what processes gold protects against and what moments of "safe haven" in gold might not be worth looking for.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team