Managing partner of MulticoinCap investments fund, Kyle Samani, outlined not the short-term outcomes from March 12, 2020, but how it may affect the future of decentralized finance development.

It's going be worse next time

Many analysts claim that the ongoing market recession is the first test for Bitcoin (BTC) and other major cryptocurrencies as a 'safe haven' for investors and a store of value and remittances instrument. Unfortunately, right now, it appears to be failing.

For example, Kyle Samani noticed that decentralized financial applications, as well as other cryptoeconomic institutions, lost integrity and synchronization during the mass liquidation. In a nutshell, the latency periods of the Bitcoin (BTC) blockchain, Ethereum (ETH) network and centralized systems may differ markedly. Thus, a certain asset, at any given moment, may have a different price on various platforms.

1/ There are two core problems

First problem:

In CEXs, time “ticks” forward measured in nanoseconds (GHz)

In Ethereum, time progresses in 15 second intervals, with high variability

In bitcoin, time progress forward every 10 minutes— Kyle Samani (@KyleSamani) March 13, 2020Advertisement

Mr. Samani dismissed almost all of the solutions to the problem of cross-system interoperability currently available, such as sharding, optimistic roll-ups, Lightning Network, etc.

He bitterly noted that neither Bitcoin (BTC) nor Ethereum (ETH) has the opportunity to solve the issues disclosed. However, a brand-new technological basis may:

New base layers with 1,000x capacity - this is the most clear solution technically, but the hardest to pull off socially. Lots of BTC and ETH bag holders

Advertisement

DeFi hard days: numbers

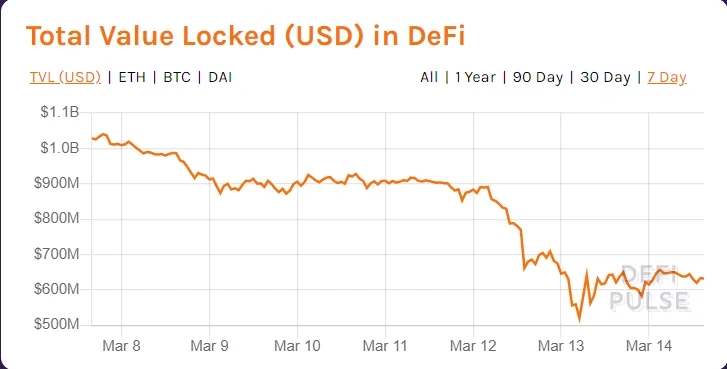

The recent bloodbath resulted in enormous liquidations on DeFi markets. According to the DeFi Pulse explorer, the amount of total value locked in DeFi applications on March 13, 2020, was 50% lower than one week ago. During the toughest hours, it barely exceeded $500M.

The heaviest losses were registered for the DAI stablecoin by Maker DAO. The recent carnage almost cut it in half as it dropped from 80.2 to 49M DAI in only two days.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov