Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The trading volume of derivatives on Cardano (ADA) has shot up by a whopping 170% in just 24 hours, according to data from CoinGlass. This surge has propelled perpetual futures on the Cardano token to over half a billion dollars in trading volume during the same period.

At the same time, data from CoinMarketCap shows that there has been a 117.88% increase in ADA trading volume on spot markets across various exchanges, with a total of $554.9 million traded. When you combine both spot and derivatives markets, the total trading volume of the Cardano token has reached a remarkable $1.09 billion in the past day.

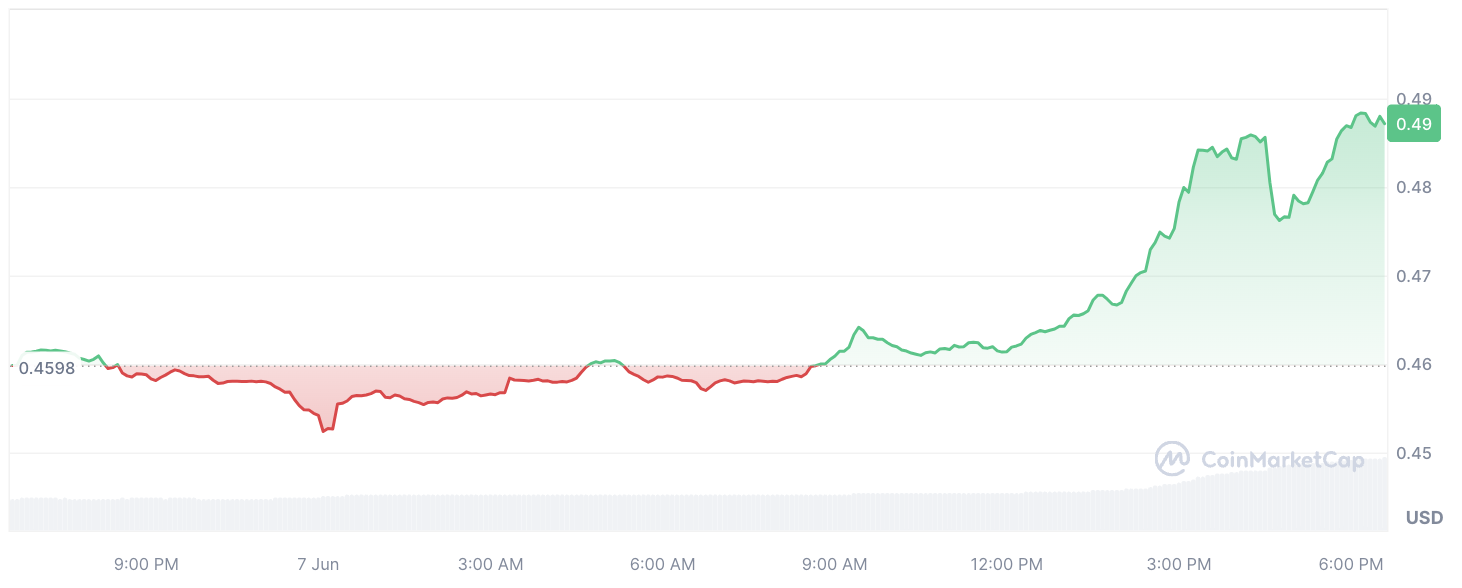

This surge in trading activity comes at a time when the price of the Cardano token is also on the rise. Since the opening of the latest daily candle, ADA has seen a solid increase of over 6%, reaching $0.49 — a level unseen in the past 17 days.

It is likely that the volume growth is due to the FOMO among market participants. Over the past few weeks, the price action of the Cardano token has severely depleted investors and traders with its low-volatility movement. Against this background, jokes even began to appear that ADA at $0.45 is a stablecoin.

The unexpected pump of the Cardano price could, on the contrary, provoke the fear and greed of market participants who were left behind, and make them ape into Cardano. In any case, the growth in trading volumes signals increased interest and attention on the popular cryptocurrency, which means increased volatility and drama.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin