It recently became known that the stablecoin Ripple USD (RLUSD) from the eponymous San Francisco crypto company has been officially launched. The stablecoin will work on two networks simultaneously — at least that is the plan now. Those two networks are Ethereum and, of course, Ripple's "native" ledger, XRP Ledger (XRPL). All users can already officially interact with RLUSD.

On various decentralized exchanges, the price of the stablecoin initially fluctuated within a range of 20%, as Ripple USD is initially pegged to the U.S. dollar 1 to 1. However, according to XPMarket, the price of RLUSD has now settled at $1.

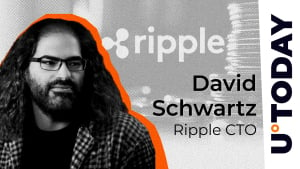

Ripple CTO David Schwartz recently warned of something like this, saying that there could initially be a shortage of stablecoin supply, which could lead to an increase in the price of the coin, which should literally be stable in price.

Interestingly, with the launch of the stablecoin, the price of XRP at one point experienced a sharp drop of more than 2.2%, dropping to $2.635 per token at one point. It is likely that this was due to users exchanging the cryptocurrency for RLUSD for testing purposes or just hype. Nevertheless, at the time of writing, the XRP rate is already recovering and turning green.

In the near future, we should expect Ripple USD to be listed on major exchanges such as Bitstamp or Mercado Bitcoin. However, services such as MoonPay are already offering stablecoin purchases via Apple Pay. A number of other off- and on-ramp services also work with RLUSD.

The history of the crypto market has seen many examples of both successes and failures in the stablecoin segment. It is now predicted that this niche will exceed $2.3 trillion in the coming years. Where and how Ripple USD will fit in is an interesting question.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov