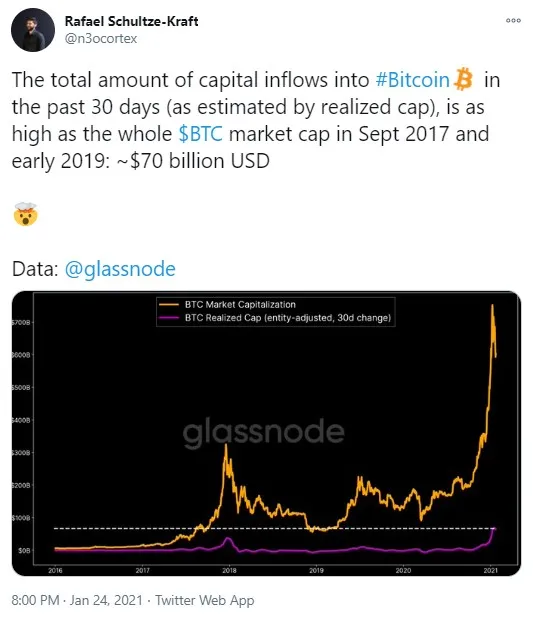

Glassnode founder and CTO, Rafael Schultze-Kraft, has taken to Twitter to share data about substantial capital inflows Bitcoin has seen over the past calendar month.

Approximately $70 billion put into Bitcoin in past 30 days

Rafael Schultze-Kraft tweeted that, over the past 30 days, capital inflows from financial institutions into Bitcoin have totaled an eye-popping $70 billion (as estimated by realized market cap).

He emphasizes that this is similar to the total Bitcoin market cap value back in September 2017 and winter 2019. In December 2017, Bitcoin reached its previous all-time high of slightly under $20,000 as it surged from the $7,000 area within just a few months. Back then, Bitcoin hype was high and lots of retail investors were jumping on the bandwagon.

Institutional interest in Bitcoin soars: Tyler Winklevoss

One of the "crypto twins" and a cofounder of the Gemini crypto exchange, Tyler Winklevoss, believes that the wave of interest by financial institutions in Bitcoin has been spiking recently.

In a recent tweet, Tyler mentioned a great amount of hedge fund managers and other investors who have asked him about Bitcoin since they—even the most conservative of them—are worried about the prospects of the U.S. dollar and they want to know how Bitcoin can help them save their cash from devaluation.

The amount of hedge fund managers and investors that I've been talking to lately about Bitcoin has never been greater. Even the most conservative of them are worried about the future of the US dollar. They all want to learn how to stack sats to protect their funds and themselves.

Bitcoin struggles to recover to $40,000 but demand not strong enough: JP Morgan

According to JP Morgan analysts, Bitcoin's rise to the $42,000 level observed on Jan. 8 was due to cash inflows from investors into the Grayscale hedge fund.

However, the JP Morgan team says that the impulse Grayscale Bitcoin Trust receives from investors is not strong enough to push Bitcoin back above the $40,000 price mark.

Last week, the company's Bitcoin Trust saw several major drops in funds inflows (22 percent and 17 percent) with the company's total AUM slipping to $24.2 billion (as of Jan. 22).

The share of Bitcoin Trust in that amount is around $20 billion.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin