Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

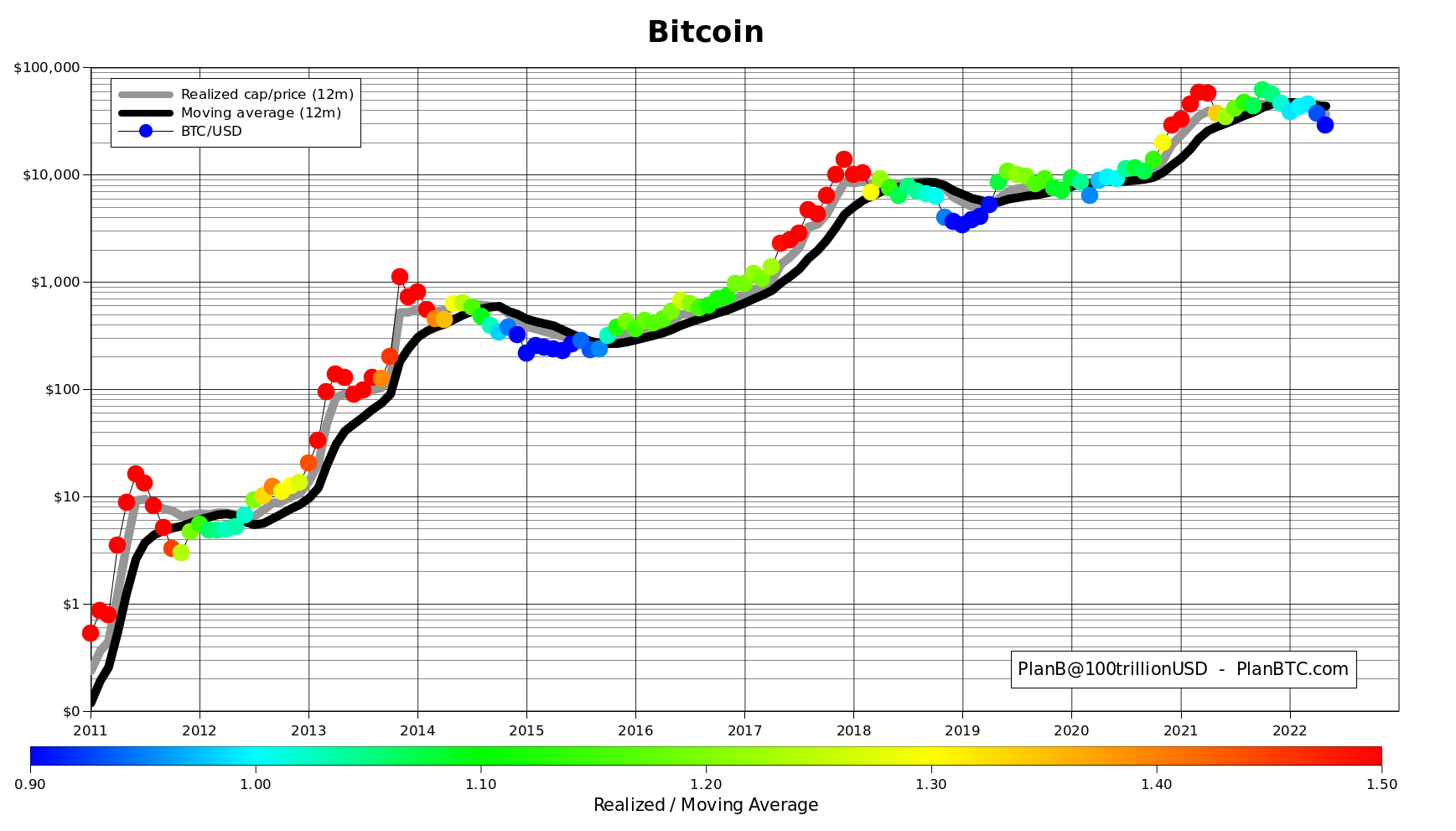

The notorious stock-to-flow model that was perfectly predicting the direction of Bitcoin's movement until the massive correction we saw in May and June suggests that the first cryptocurrency will reach $72,000 this week, but it is unlikely to happen.

Main problem with S2F model

Previously, a Fidelity analyst explained why S2F is no longer accurate and will not be in the future. S2F's main source of prediction is the scarcity of the asset, which cannot drive the price alone, especially in modern markets.

With Bitcoin, we should add adoption to scarcity to see better results. Unfortunately, it is almost impossible to accurately calculate the technology's adoption rate in the future even if we compare it to similar technologies like mobile devices or the internet.

The current deviation from the price model is one of the biggest the market has seen in the history of its existence, suggesting that stock-to-flow can no longer be used for determining future price levels of Bitcoin.

Lack of purchasing power on Bitcoin

The reason why S2F's price forecast is unlikely to happen is the inability of retail traders alone to push the price of the digital gold as high as the model suggests. As U.Today previously mentioned, institutional investors have sold around $500 million worth of BTC holdings following the crash of the cryptocurrency market.

It is not yet clear when institutional investors will return to the cryptocurrency market, especially after the fiasco on Ethereum's lending and borrowing market that caused a massive cascade of liquidations and margin calls. Companies like 3AC, Celsius and many foundations had to stop their operations following Ether's plunge below $900.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov