Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a dramatic turn of events, the crypto market witnessed a sudden collapse in digital asset quotes, with Bitcoin (BTC) leading the plunge.

The price of Bitcoin plummeted by more than 8%, nosediving from $43,810 to $40,272 in less than an hour.

The shockwave resulted in a staggering $353.61 million in liquidated positions across the entire market spectrum, catching many bullish investors off guard.

Notably, 88.7% of the liquidated positions in BTC alone were long positions, totaling almost $100 million in the past 12 hours.

Calm before the storm

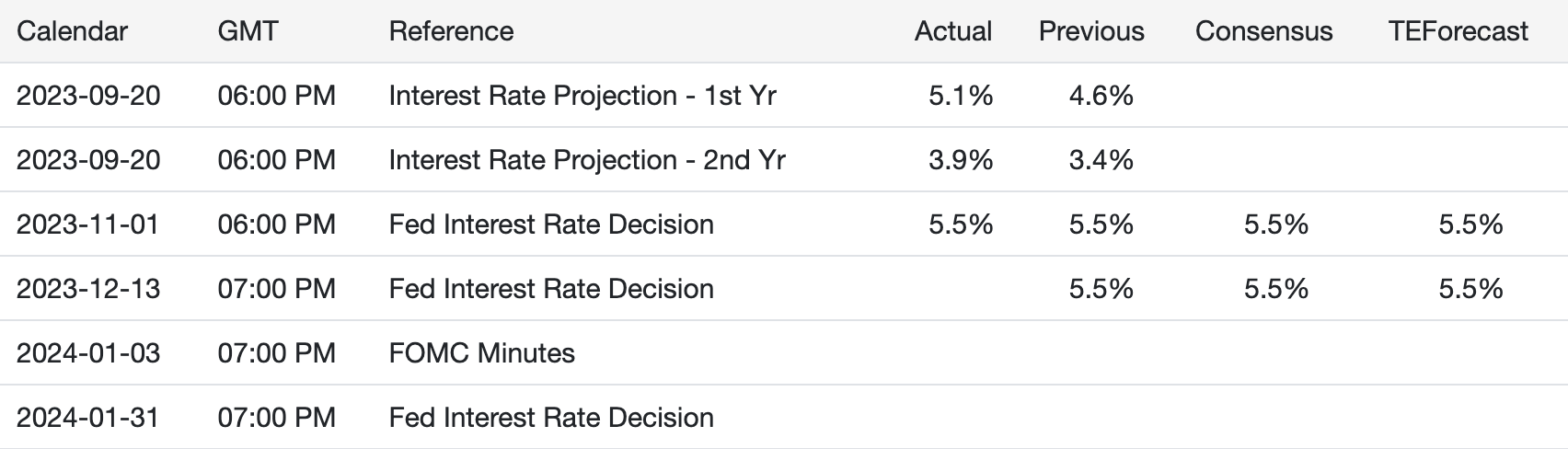

However, for market participants, this may just be the calm before the storm, as all eyes turn toward Wednesday, Dec. 13 on the calendar, when the U.S. Federal Reserve is set to make a crucial decision on the key interest rate.

The crypto market, now more institutionalized than ever, reacts strongly to such decisions, often more profoundly than traditional financial markets under the Fed's monetary policy.

The impending Fed rate decision is expected to send crucial signals to market participants, offering insights into the economic landscape for the coming month. Of paramount importance is the question of how long the era of expensive money will persist and whether the "money printer," which catalyzed the crypto market's exponential growth two years ago, will be reignited.

The last time the Federal Reserve made a similar decision on Nov. 1, Bitcoin experienced a 3% dip, followed by a robust 5.5% surge. Such market dynamics are not uncommon during these events, signaling an imminent shakeout.

For inexperienced investors, the advice is clear: brace yourself for potential turbulence and consider sidelining on the decisive day in 48 hours.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin