Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

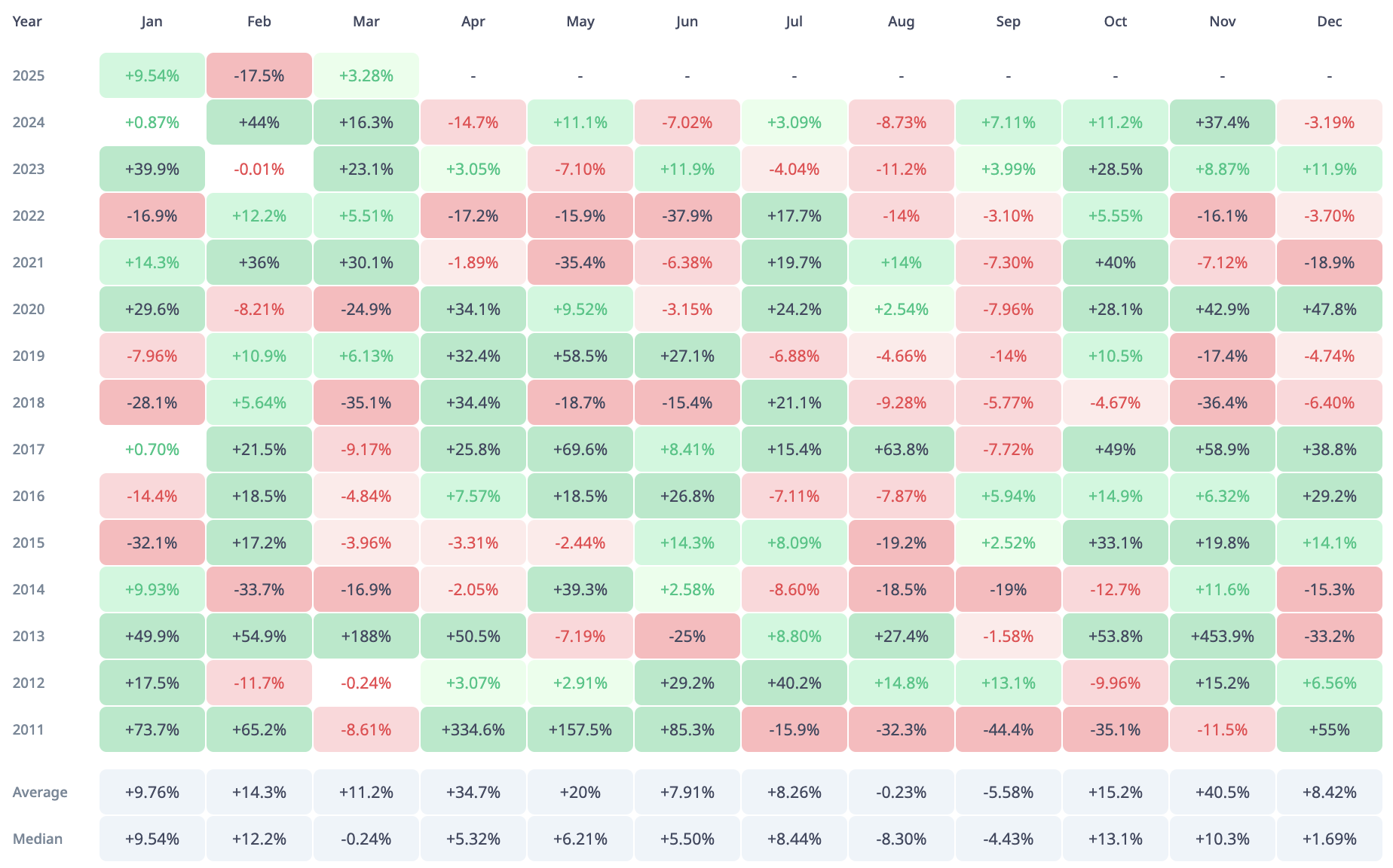

Bitcoin (BTC) may be poised for a 34% surge in the coming month of April, according to the price history of the leading cryptocurrency. As data from CryptoRank presents, the average return of investment for Bitcoin in the fourth month of the year stands at 34.7%.

Since 2011, when the price of the leading cryptocurrency began to be tracked, there were nine positive months of April, and five negative. The Bitcoin series in back-to-back positive Aprils was from 2016 to 2020, when the cryptocurrency soared by 30% on average in each of these months.

What adds to the confidence that Bitcoin may see gains in April is the fact that the median return for BTC is also positive—arguably even more telling than the average, since medians are not as easily skewed by extreme outliers.

That said, let’s not ignore the flip side: April has not always been kind to BTC holders. Take 2024, for instance, when BTC dropped nearly 15% in April, or 2022, when it slid over 17% during the same month.

Now, here is where things get interesting. While historical trends cannot predict the future with certainty, they do offer a rough sketch of what might happen — and right now, that sketch looks pretty bullish.

The fact that Bitcoin has closed April in the green more often than not, especially during key bull cycles, suggests that momentum could be on its side.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov