During a Nov. 18 interview with Yahoo! Finance, Binance.US CEO Catherine Coley mentioned that Bitcoin’s rally to its highest level since December 2017 was mainly dominated by spot traders.

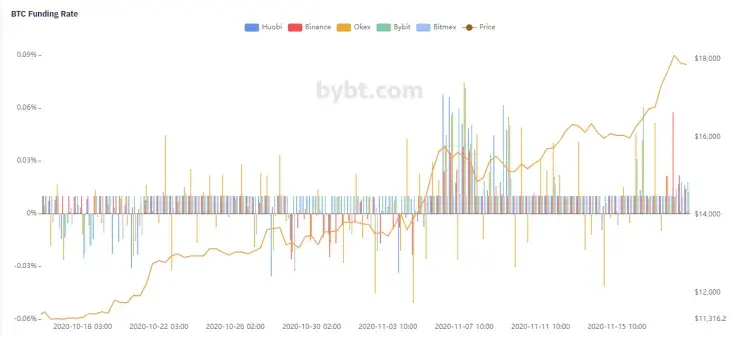

She pointed to the fact that the funding premiums of perpetual futures contracts were still “relatively low,” remaining in the same range where they were a month ago.

Derivatives traders are not enthusiastic

Funding rates are unique to derivatives trading platforms that offer never-ending contracts.

If futures trade higher than spot, traders with long positions have to pay the short side of the market (and vice versa).

According to data provided by Bybt, eight-hour funding rates across Binance, OKEx, Huobi are close to zero, signaling subdued bullish sentiment. Meanwhile, FTX is actually in the red at the time of writing.

This lack of enthusiasm means that the derivatives market is far from being overheated. Very high funding rates are often followed by a significant correction.

We didn’t see this in 2017

As reported by U.Today, Bitcoin skyrocketed to a new 2020 peak of $18,483 earlier today before seeing a pullback.

Coley further claimed that the current uptrend was being driven “real gains in validation” that hadn’t been there in 2017:

“For the first time ever, you are seeing congressmen and women understanding Bitcoin. You are seeing massive macro investors understanding Bitcoin. You are even seeing corporate treasuries understanding and adding Bitcoin to their Balance sheets.”

Advertisement

Yet, according to Coley, the industry is not sitting on its laurels as it continues to build and evolve.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin