Another day, another yearly high.

Bitcoin, the dominant cryptocurrency, hit $18,483 at 04:54 UTC on the Bitstamp exchange.

It was now up over 370 percent from its March low of $3,850, coming close to its current all-time high of $19,664.

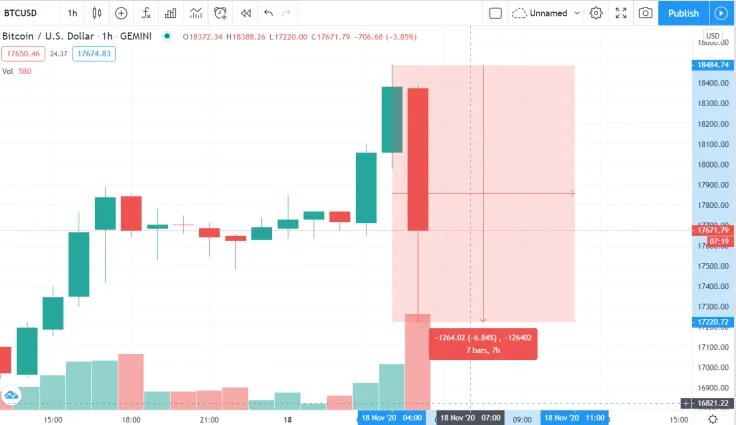

The rally has cooled off, with Bitcoin plunging seven percent during an extremely volatile hour.

The new gold

The parabolic rally gives analysts plenty of food for thought as they are struggling to figure out what exactly is driving Bitcoin to new yearly highs almost on a daily basis.

J.P. Morgan’s managing director Nikolaos Panigirtzoglou recently told The Guardian that the world’s biggest cryptocurrency poses as a viable alternative to gold:

“There is a reassessment about its value here as an alternative currency; as an alternative to gold.”

CryptoCompare’s Charles Hayter believes that Bitcoin has matured enough for legacy financial institutions to be comfortable with it:

“The gap between the crypto world and traditional financial institutions has closed dramatically”

Advertisement

Finally, many believe that PayPal’s endorsement of crypto was the spark that lit the powder keg.

Bitcoin’s staying power

At $340 bln, the value of the Bitcoin network surpassed that of financial services behemoth Mastercard while zeroing in on JPMorgan.

The total market capitalization of all cryptocurrencies has also reached a significant milestone of $500 bln for the first time since Dec. 17, 2017. Bitcoin stands out as the only cryptocurrency in the top 10 that has a higher market cap as of now.

IOTA, which was worth $13 bln almost three years ago, has dwindled to $731 mln. Meanwhile, Bitcoin Gold has plunged from $4.4 bln to $164 mln.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin