Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

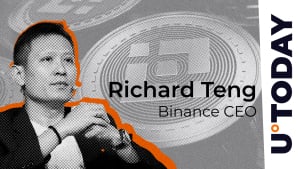

Binance CEO Richard Teng has addressed a common misconception in the crypto space wherein people assume that they might have missed the chance to enter the market.

In a recent tweet, Teng highlighted the common misconception that it is "too late" to get involved in crypto, with some believing that the best opportunities might have already passed, causing them to overlook the continuous innovations shaping industries worldwide as a result of this erroneous belief.

Teng wrote, "A common misconception about crypto is that it’s too late to get involved. Many believe the best opportunities are gone, causing them to overlook innovations that are transforming industries and lives worldwide."

The Binance CEO statement serves as a reminder that blockchain technology and crypto adoption are still in their early stages, with new projects and use cases emerging constantly. As the cryptocurrency market evolves, it continues to provide new opportunities for investors and innovators alike.

Teng's comments come as the crypto market is exhibiting signs of recovery, with some assets rebounding from recent corrections. Bitcoin and other major cryptocurrencies are trading in the green.

What's happening?

Bitcoin stayed steady at nearly $88,000 as traders await U.S. data releases, especially the impending Personal Consumption Expenditure (PCE) data, which influences Fed interest rate decisions and hence affects Bitcoin prices. Majors changed little in the last 24 hours, with Solana's SOL, XRP, BNB Chain's BNB and Ethereum (ETH) rising less than 2%, while Dogecoin (DOGE) outperformed with an 11% increase.

Shiba Inu (SHIB) soared 14%, aided by a shift to meme tokens and a 228% increase in the ShibaSwap exchange in the last 30 days. Open interest in SHIB-tracked futures has increased by more than 20% since Sunday, indicating potential volatility.

In big news for the markets, GameStop announced that its board of directors unanimously approved the addition of Bitcoin as a treasury reserve asset, joining a rapidly growing list of publicly traded companies implementing a Bitcoin treasury strategy.

BlackRock's BUIDL fund, which now owns $1.7 billion in cash and U.S. Treasuries and expects to reach $2 billion by April, is now live on the Solana blockchain after debuting on Ethereum last year. The expansion underscores the increasing adoption of blockchain-based financial products by large asset managers.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin