Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Binance, the world's largest cryptocurrency exchange, has hit a major milestone, surpassing 200 million users. This achievement places the exchange in a unique position of influence, comparable to the population of the eighth largest country in the world.

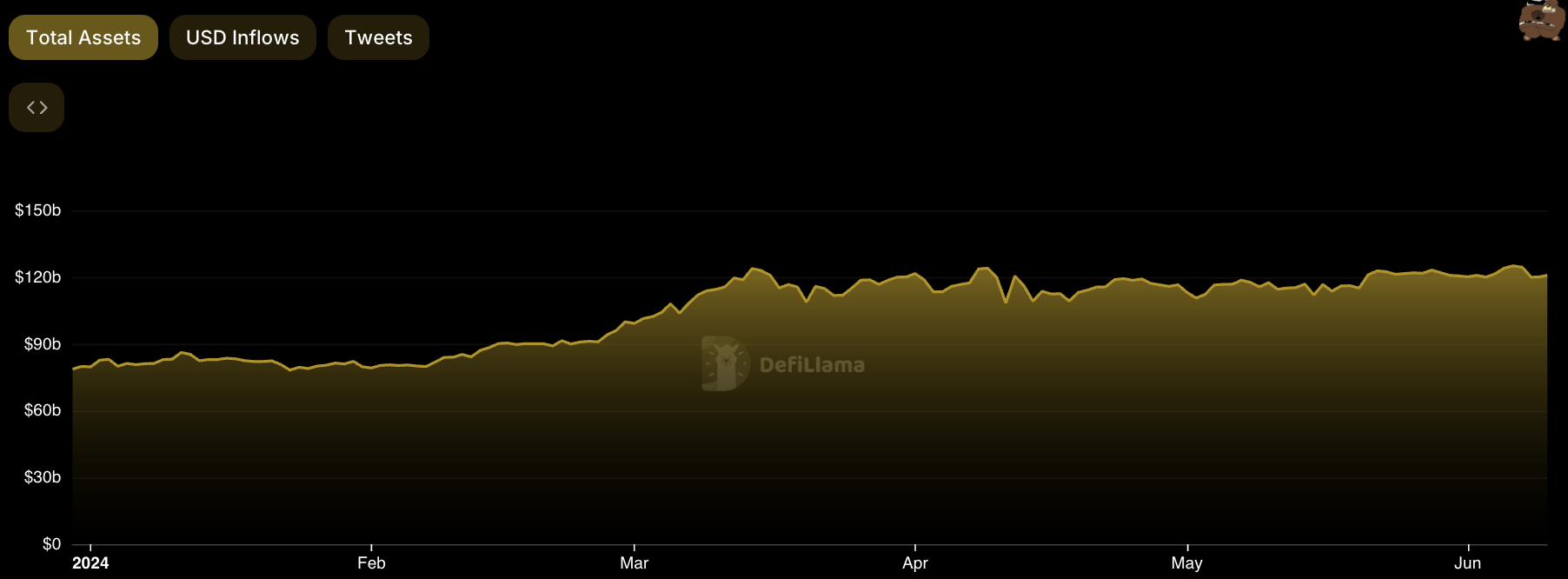

This remarkable growth is reflected in Binance's substantial holdings. According to DefiLlama, the exchange manages $120.86 billion in user funds. This translates to an average of $604,295 per user, highlighting the considerable financial activity within the platform.

Binance's dominance in the market is further evidenced by its position as the largest centralized exchange, outpacing its closest competitor, OKX, by nearly $100 billion.

The surge in user numbers has coincided with significant milestones for Binance's native token, BNB. Recently, it reached an all-time high of $721.8, marking a pivotal moment for the cryptocurrency.

With a current market capitalization of $100.57 billion, BNB is now the fourth largest digital asset, trailing only behind Bitcoin, Ethereum and USDT. This achievement solidifies BNB's status within the top echelons of the cryptocurrency market.

As Binance continues to expand its user base and financial influence, questions arise about the future trajectory of the platform and its native token.

The exchange's growth and colossal user engagement suggest a promising future, yet there is speculation about whether this impressive parade of numbers represents a peak for Binance and the crypto market in general.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin