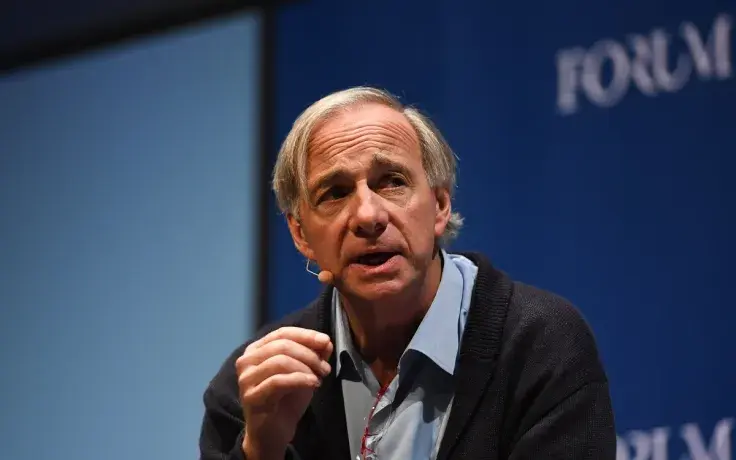

In a Nov. 17 Twitter thread, Bridgewater Associates CEO Ray Dalio has expanded on his recent comments about Bitcoin that have been on everyone’s lips within the cryptocurrency community as of recently.

The billionaire hedge fund manager now says that Bitcoin could become “too dangerous” to use if it ends up being successful enough to pose a serious threat to fiat currencies:

“If it becomes successful enough to compete and be threatening enough to currencies that governments control, the governments will outlaw it and make it too dangerous to use.”

Dalio might be missing something about Bitcoin

As reported by U.Today, the Bitcoin community was up in arms after Dalio commented about governments potentially outlawing the world’s largest cryptocurrency, with Twitter CEO Jack Dorsey himself rebuking FUD.

A possibility of a global regulatory clampdown is not the only problem that Dalio has with Bitcoin. The eminent investor still refuses to use it as an effective currency since he believes it can serve as neither a medium of exchange or a good store-hold of value.

While fellow hedge fund manager and philanthropist Stanley Druckenmiller recently recognized Bitcoin as a better alternative to gold, Dalio doesn’t see central banks or multinational corporations adopting it:

“If it becomes successful enough to compete and be threatening enough to currencies that governments control, the governments will outlaw it and make it too dangerous to use.”

Advertisement

Unlike some other ardent naysayers, Dalio, however, keeps an open mind about Bitcoin, claiming that he would love to be corrected.

The importance of being early

The billionaire’s comments came right before Bitcoin hit $17,534, its highest level since December 2017, on the Bitstamp exchange.

Even though Bitcoin treasuries only account for a minuscule 0.04 percent of the S&P 500 index, those companies that were early to the party are already repeating huge returns.

MicroStrategy, whose Bitcoin bet shocked Wall Street earlier this year, is now up over $240 mln.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin