Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

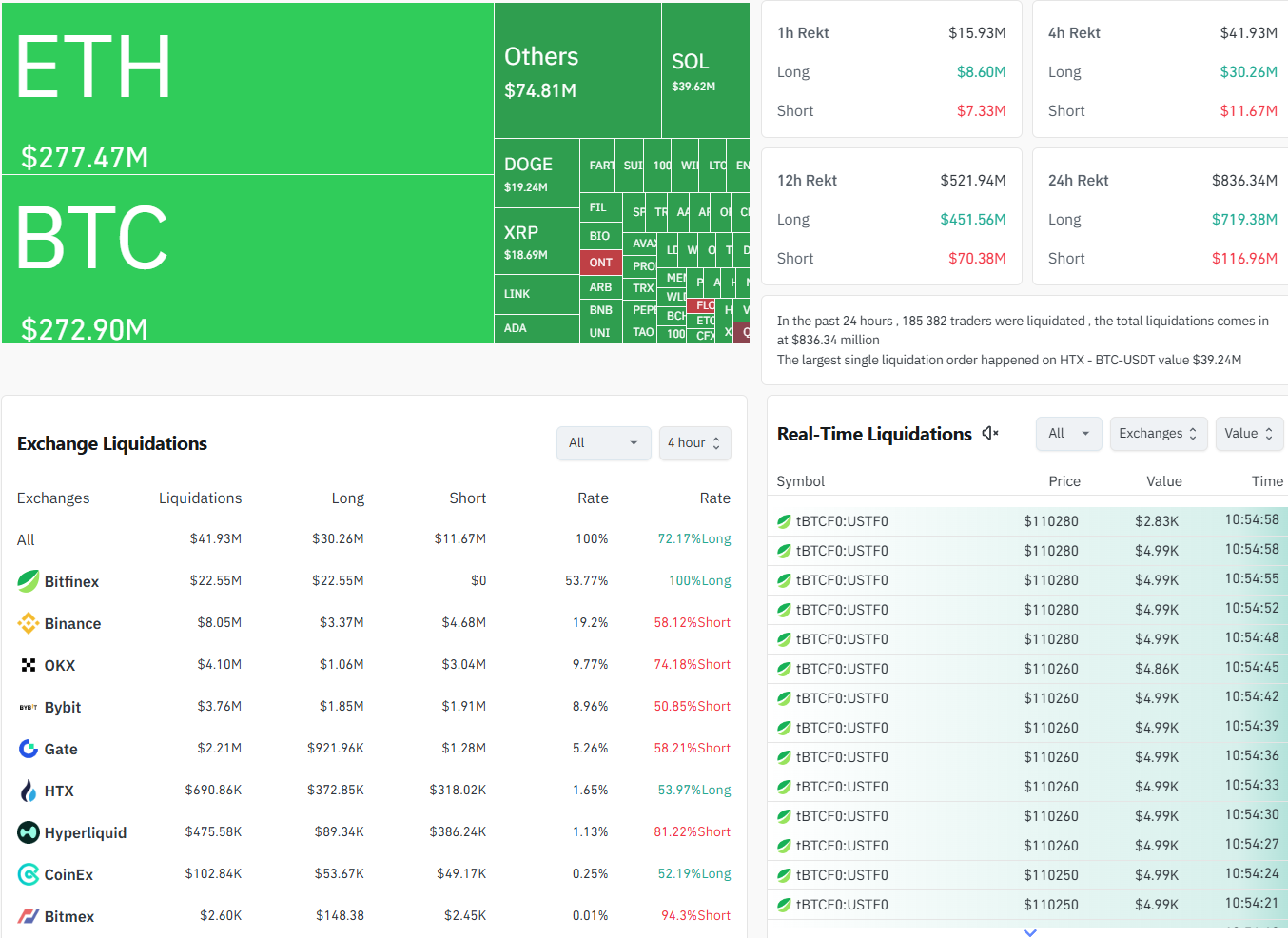

One of the most severe shakeouts to hit the cryptocurrency market in months is here. More than 193,000 traders lost more than $891,000,000 in leveraged positions in a single day, according to CoinGlass data.

According to the heatmap, Bitcoin and Ethereum are driving the carnage, with BTC coming in second at $275,000,000 and ETH seeing liquidations above $290,000,000. Significant losses were sustained by Solana, Dogecoin and XRP, with a series of liquidations compounding overall losses.

Bulls take massive damage

The disparity between long and short liquidations makes it obvious that longs were the most severely damaged. Almost $757,000,000 worth of long positions were lost in the last day alone, while only $116,000,000 worth of short positions were lost.

The failure to maintain momentum has now led to a series of forced sell-offs, despite the fact that bullish leverage had been building aggressively during Bitcoin’s ascent above $120,000. You can see the damage on the Bitcoin chart.

Testing Bitcoin resistances

Bitcoin recently made two tests of the $122,000 resistance level but was unable to make a strong breakthrough. Following the rejection, there was a decline below important moving averages, such as the 20- and 50-day lines.

Bitcoin is currently trading just over $110,000 in a balanced position close to the 100-day moving average. The asset could move toward $103,000, where the 200-day moving average is the last reliable support, if there is another breakdown.

Even though selling pressure has been fierce, a short-term relief bounce is still possible, as the RSI is currently trending close to oversold levels. The bigger picture, however, appears precarious: investor confidence has been damaged, and large-scale liquidations frequently leave lasting damage to market psychology.

What's next?

What to anticipate next: Bitcoin’s momentum may level out if it can hold above $110,000 and swiftly recover $115,000. The next leg down, however, might come quickly if bears push the price below the $108,000-$110,000 support band, pulling the market as a whole into further correction territory.

The $891,000,000 carnage brings to light a persistent reality of cryptocurrency markets: positions with excessive leverage are a major source of volatility. This may be the end of the leverage-driven rally for Bitcoin unless spot demand picks up steam.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov