Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

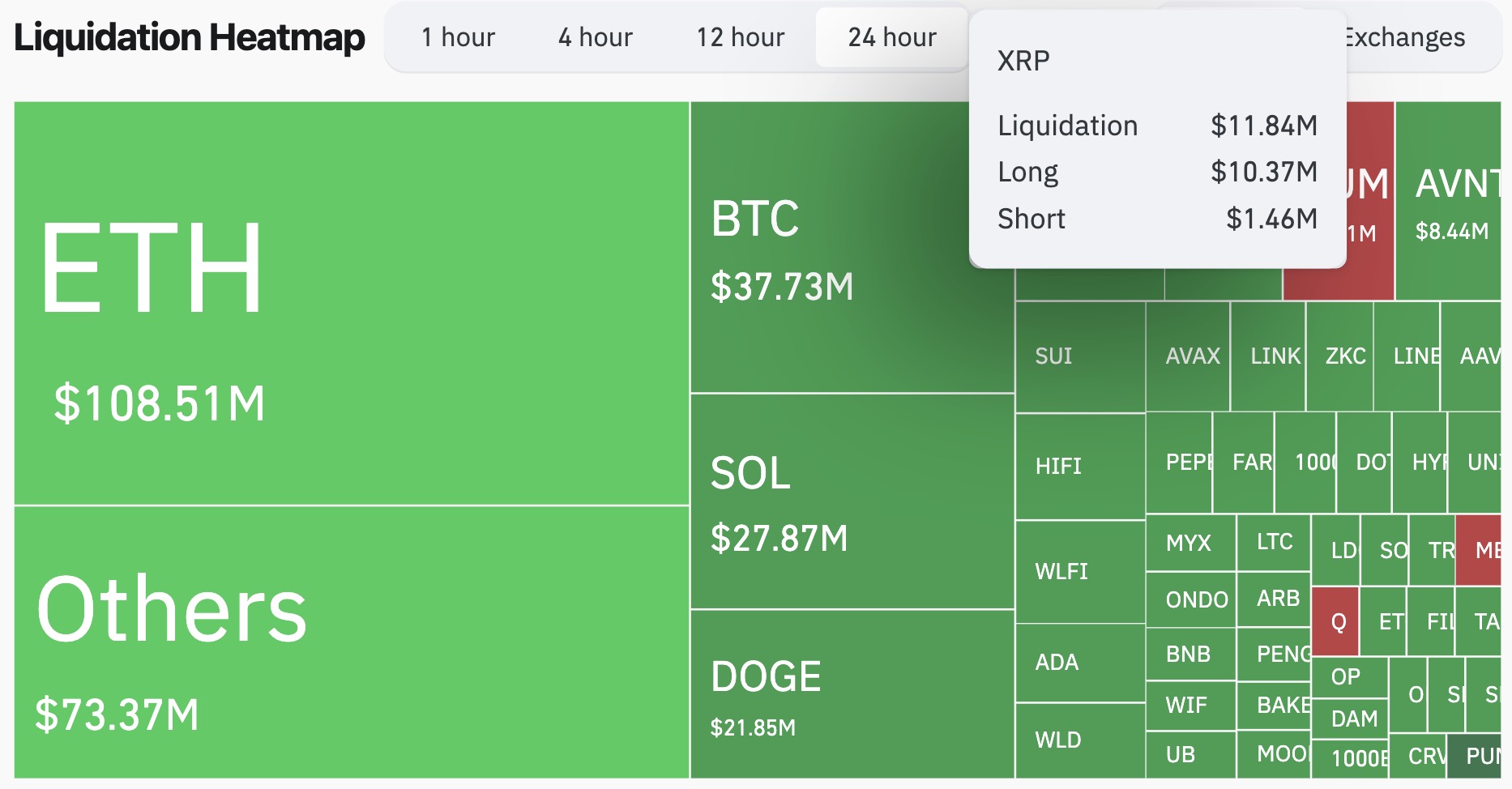

XRP traders have been caught on the wrong side of the market over the last day, with fresh data by CoinGlass showing a big gap between long and short liquidations. In total, $11.84 million in XRP was wiped out in the last 24 hours.

Of that, $10.37 million came from long positions, while just $1.46 million came from shorts. This means there is now a massive 710% difference, showing just how one-sided leverage had become before the market moved against it.

It is easier to spot the difference when you compare it to wider crypto liquidations. Ethereum was top of the list with $108.5 million, Bitcoin came in at $37.7 million and Solana got $27.8 million. What makes XRP stand out is that its total is lower in dollar terms, while the scale of the imbalance is huge.

It was price action that led to the surge.

XRP price outlook

The chart shows XRP dipping to $2.96 in the early hours before recovering back toward $2.99. There has been some volatility, but the trading range has stayed pretty tight compared to the liquidation figures, making it look stable on spot markets while derivatives traders took the hardest hit.

The difference between what you can see on price charts and what is actually happening with leveraged positions is as obvious as it has ever been.

At the moment, the $3 level is still the main reference point. If the XRP price can hold onto that line, it might help to steady things after a day of forced selling. If it does not, the liquidation trend could carry on, as traders who have just reset their positions might have to make adjustments again.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov