A rough 24 hours in the crypto market, and it is not just about the numbers. Over half a billion dollars wiped out in liquidations — $555 million, to be exact. That’s not even counting Friday night, when things really started tumbling.

Most of those liquidations? Long positions. No surprise there. The logic was simple: Everything has been going up, so it should keep going up. Buy the dip, right? Well, not quite.

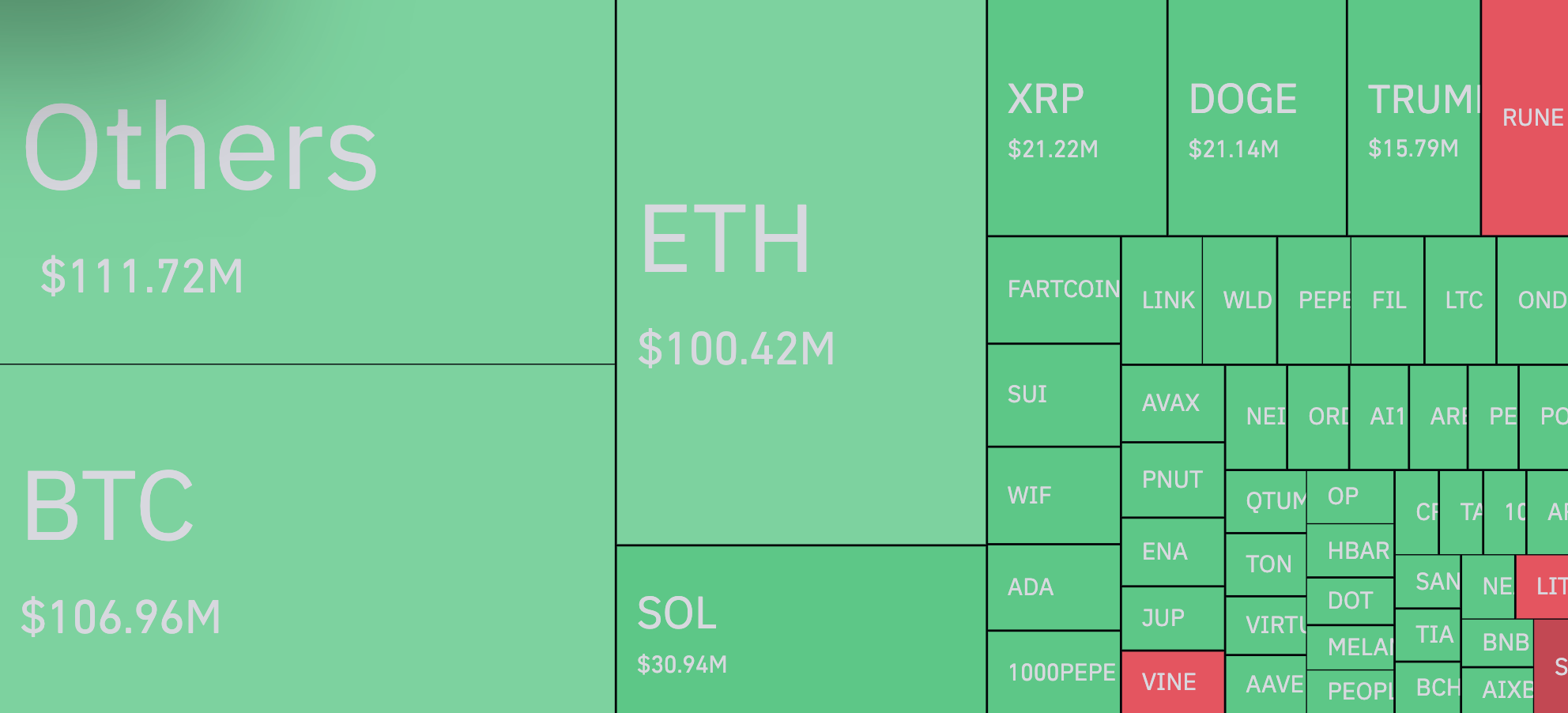

Bitcoin spot traders might be used to this rhythm, but futures tell a different story. CoinGlass data lays it out — out of that $555 million in liquidations, just $68 million were short positions. The rest? Longs caught off guard. Bitcoin futures alone saw $105 million liquidated, with a staggering 90.4% of those being longs.

But surprisingly, Bitcoin (BTC) was not the biggest loser here. The "Other" category, where smaller-cap cryptocurrencies fall, took an even harder hit.

Now, traders are watching what happens next. The stock market opens Monday, and it is likely to set the tone. Traditional finance has not reacted yet, which means more turbulence could be ahead for crypto. Liquidations might not be over.

"Great strategy"

And then there’s Peter Brandt, a name that carries weight in trading circles. A veteran since the 1970s, he chimed in at just the right moment with a remark that dripped with sarcasm.

He called it a "great strategy" to cut winners short and let losers run — an obvious inversion of conventional wisdom. No serious trader operates this way, making his comment less of a tip and more of a pointed critique of recent market behavior.

The crypto space is in reaction mode, adjusting to a market that refuses to behave predictably. One thing is clear: The next few days will say a lot about whether this is just a shake-up — or the start of something bigger.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov