Today, Nov. 8, 2021, Bitcoin (BTC) and Ethereum (ETH) continued their rallies after small "dips." The second cryptocurrency even managed to print a new all-time high. How many traders have been liquidated?

$172 million in shorts liquidated in 24 hours

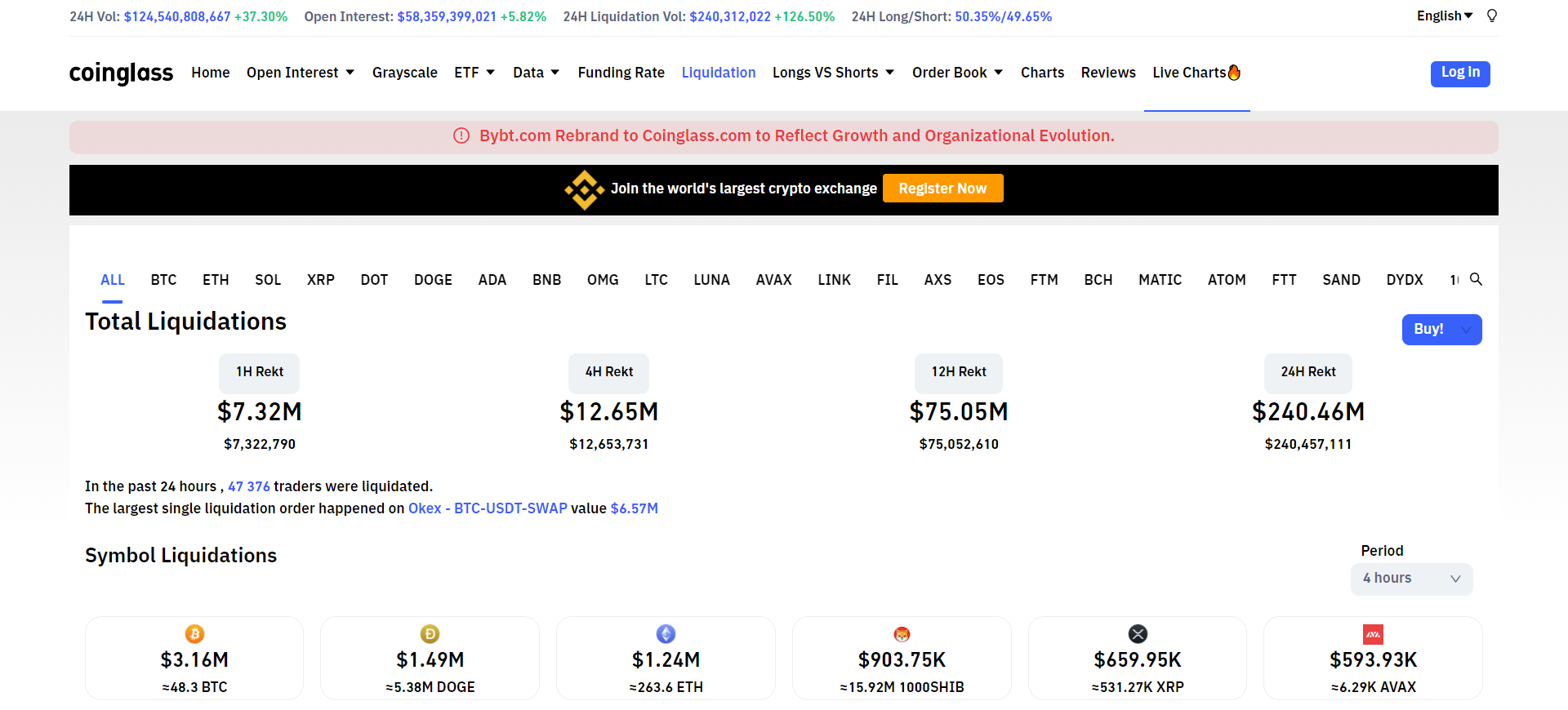

According to the leading cryptocurrency trading dashboard, Coinglass (previously, Bybt), today's session was the most painful for crypto bears in three weeks.

In the past 24 hours, $240 million in short and long positions were liquidated. A total of $130 million was lost by Bitcoin (BTC) traders, $50 million by Ethereans, and owners of XRP, DOGE, SHIB and SOL are responsible for more than $20 million in liquidations.

Seventy-three percent of liquidations registered were "shorts": 46,831 traders lost their funds in all.

The largest single liquidation was registered on OKEx in a BTC/USDT pair: a Bitcoin bear lost $6.57 million in no time.

On Oct. 19, 2021, when Bitcoin (BTC) logged an all-time high, Bitcoin (BTC) bears lost $254 million in 24 hours.

Bitcoin (BTC) surpasses Tesla and Silver in one day?

As covered by U.Today previously, today Bitcoin (BTC) surpassed Tesla by market capitalization for the first time in its history.

As such, Bitcoin (BTC) is now the eighth asset by market cap. However, some analysts are certain that Bitcoin (BTC) has sensationally surpassed Silver (XAG) by market cap.

#Bitcoin has made silver its bitch.https://t.co/x14w6SnJoH?from=article-links pic.twitter.com/Keoc554txX

— Bitstein (@bitstein) November 8, 2021

The fact of Silver being "flippened" by Bitcoin (BTC) has not been confirmed by the largest capitalization tracker, CompaniesMarketCap.

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide Denys Serhiichuk

Denys Serhiichuk