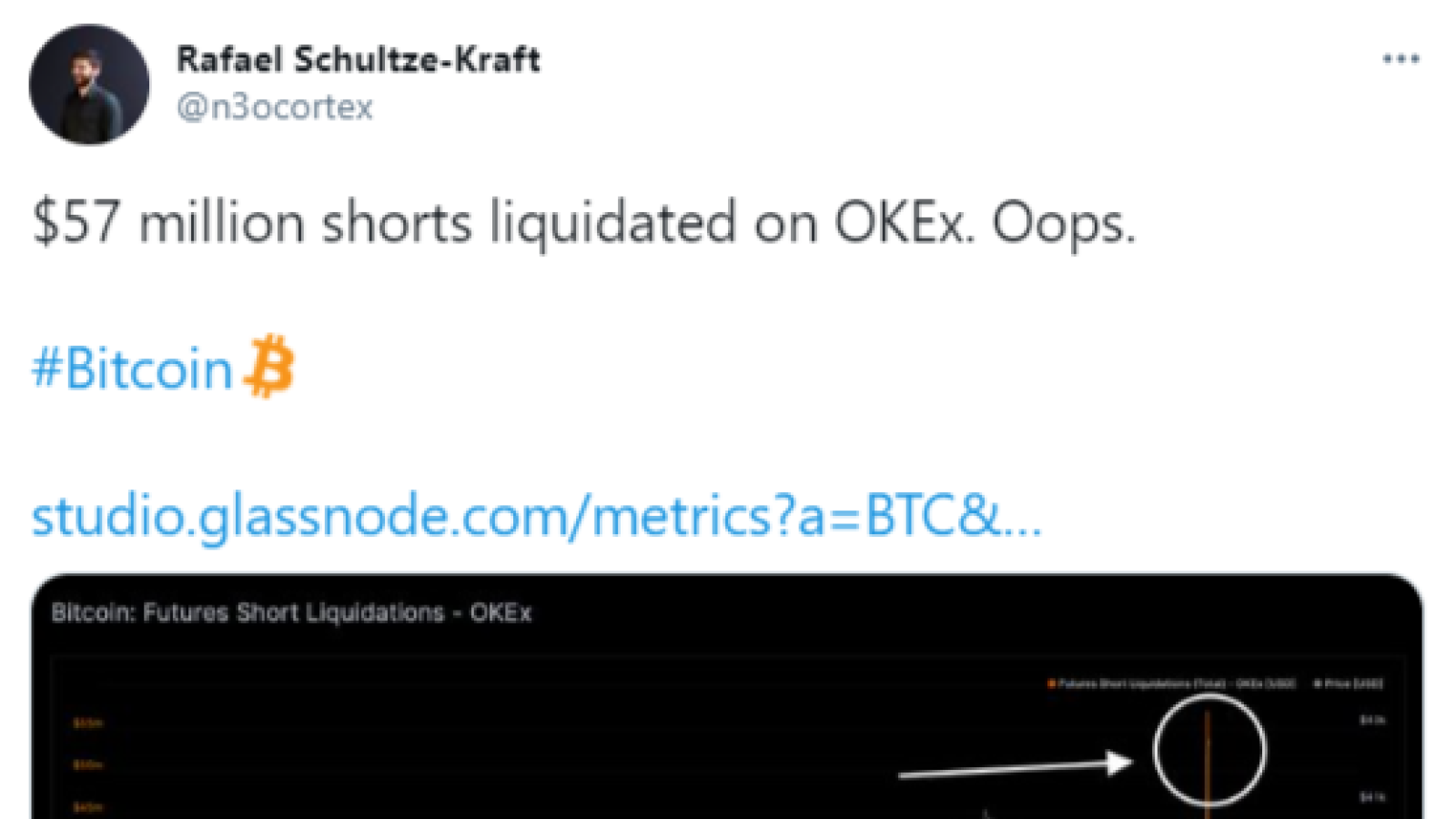

Surprising Bitcoin (BTC) upsurge above all-time high is really painful for bears, data says. According to the chart shared by Mr. Rafael Schultze-Kraft, CTO of Glassnode, the net amount of liquidations can be jaw-dropping.

OKEx shorts suffer tremendous liquidations

Mr. Schultze-Kraft, chief technology officer of leading on-chain analytical firm Glassnode, has taken to Twitter to share a really dramatic chart for Bitcoin (BTC) bears. According to the chart, the ongoing Bitcoin (BTC) price spike created a slaughterhouse for an army of disbelievers.

OKEx, one of the flagship cryptocurrency derivatives exchanges, has witnessed $57,000,000 Bitcoin (BTC) short positions liquidated in almost no time.

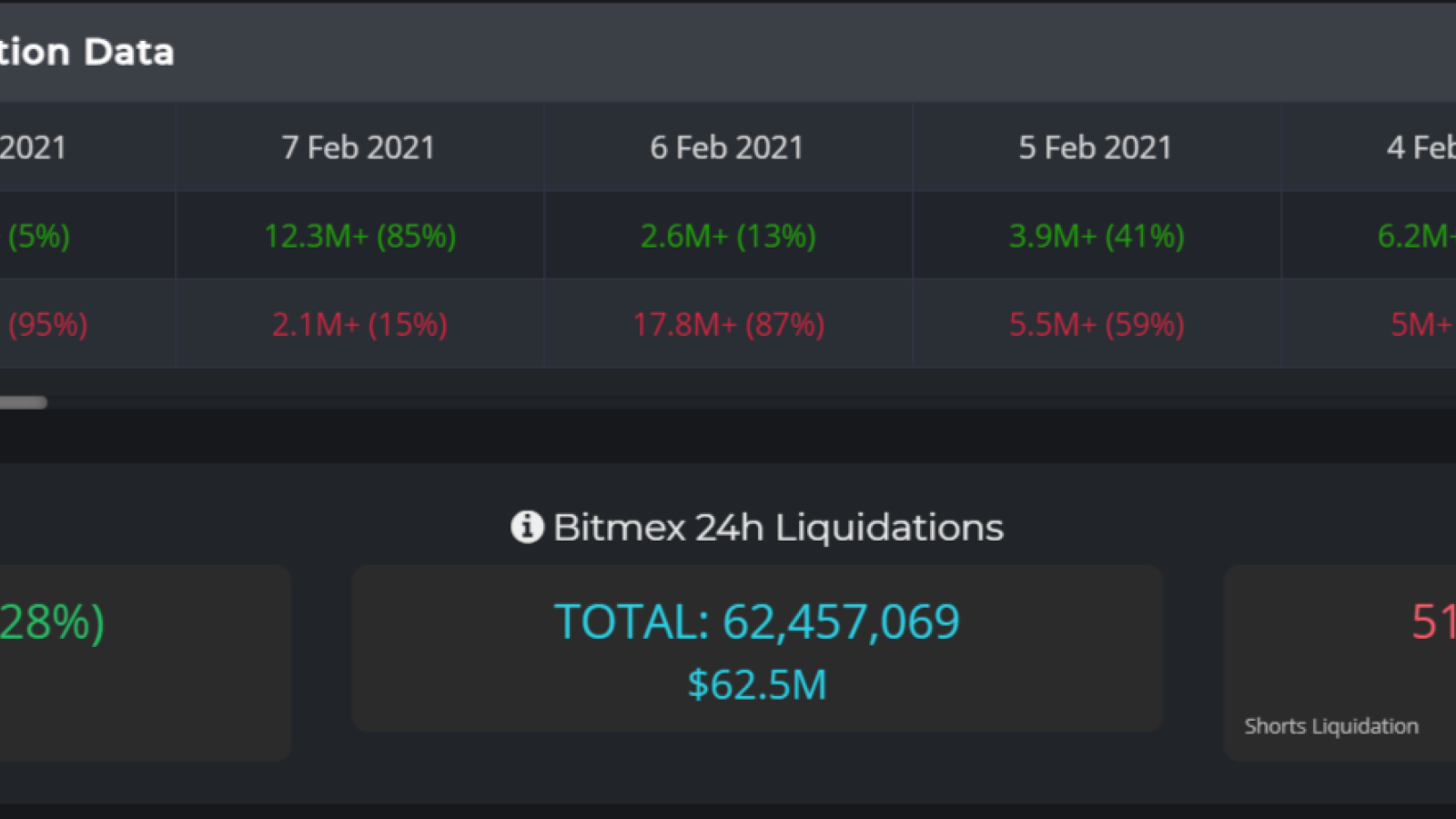

Bears from other exchanges do not feel any better. According to Cryptometer automated service, BitMEX traders lost more than $62,000,000 in liquidated shorts in the last 24 hours. It looks like most of this massive amount also vanished in the last hour.

That being said, the net volume of liquidated short positions across all major derivatives exchanges may be targeting 10-digit waters amidst an insane Bitcoin (BTC) rally.

Bitcoin (BTC) inches closer to $45,000

As covered by U.Today earlier today, the Tesla (TSLA) electric vehicles giant has reported a gargantuan Bitcoin (BTC) purchase to the U.S. SEC. Also, Elon Musk's company will enable Bitcoin (BTC) payments for their cars.

The Bitcoin (BTC) price immediately spiked more than 15 percent in 30 minutes. It managed to print a new all-time high in the sub-$45,000 zone.

Due to increased traffic, the majority of Tier-1 exchanges went offline. For instance, users of Binance (BNB) and Crypto.com reported serious issues when accessing the platforms.