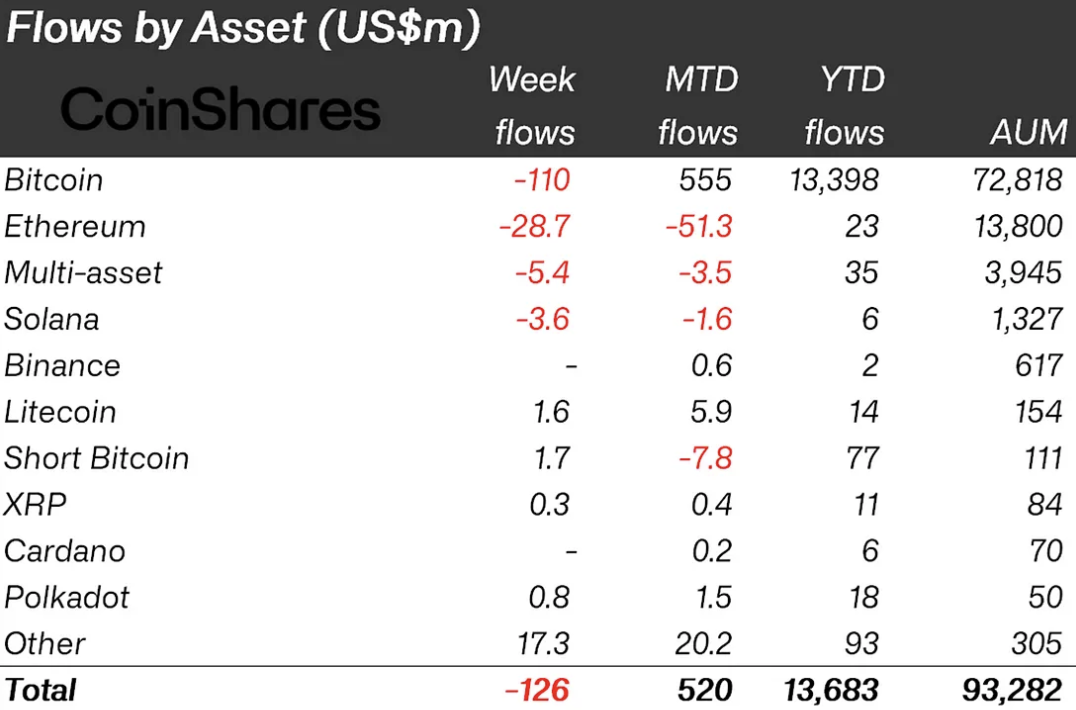

In the latest weekly fund flows report by CoinShares, the cryptocurrency investment landscape has witnessed a notable shift, with XRP emerging as a standout performer. Despite an overall outflow of $126 million from digital asset investment products, XRP-focused vehicles have bucked the trend by attracting a staggering $300,000 in inflows over the past seven days.

This marks a remarkable 300% surge compared to the previous week, reflecting a significant uptick in investor sentiment toward XRP-related financial instruments.

With total inflows into investment products reaching $11 million since the beginning of the year, XRP has positioned itself as a leading contender among altcoins, surpassing the likes of Solana and Cardano. However, it still trails behind heavyweights like Polkadot, Litecoin and Ethereum in terms of overall fundraising.

The surge in XRP investment comes at a time when broader market dynamics are shifting. While Bitcoin retained positive month-to-date inflows despite experiencing $110 million in outflows last week, Ethereum faced significant challenges, witnessing $29 million in outflows for the fifth consecutive week.

When XRP ETF?

Despite the promising influx of funds into XRP investment products, the once-buzzing talks of a full-fledged XRP ETF have dwindled in recent months. Instead, attention on the U.S. regulatory landscape has shifted toward the Ethereum ETF, with prospects for approval diminishing as the May 23 deadline approaches. The fate of an XRP ETF remains uncertain, contingent upon regulatory developments and industry dynamics.

As XRP continues to demonstrate resilience and attract investment amid market volatility, the possibility of regulatory hurdles being overcome could reignite discussions surrounding an XRP ETF.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov