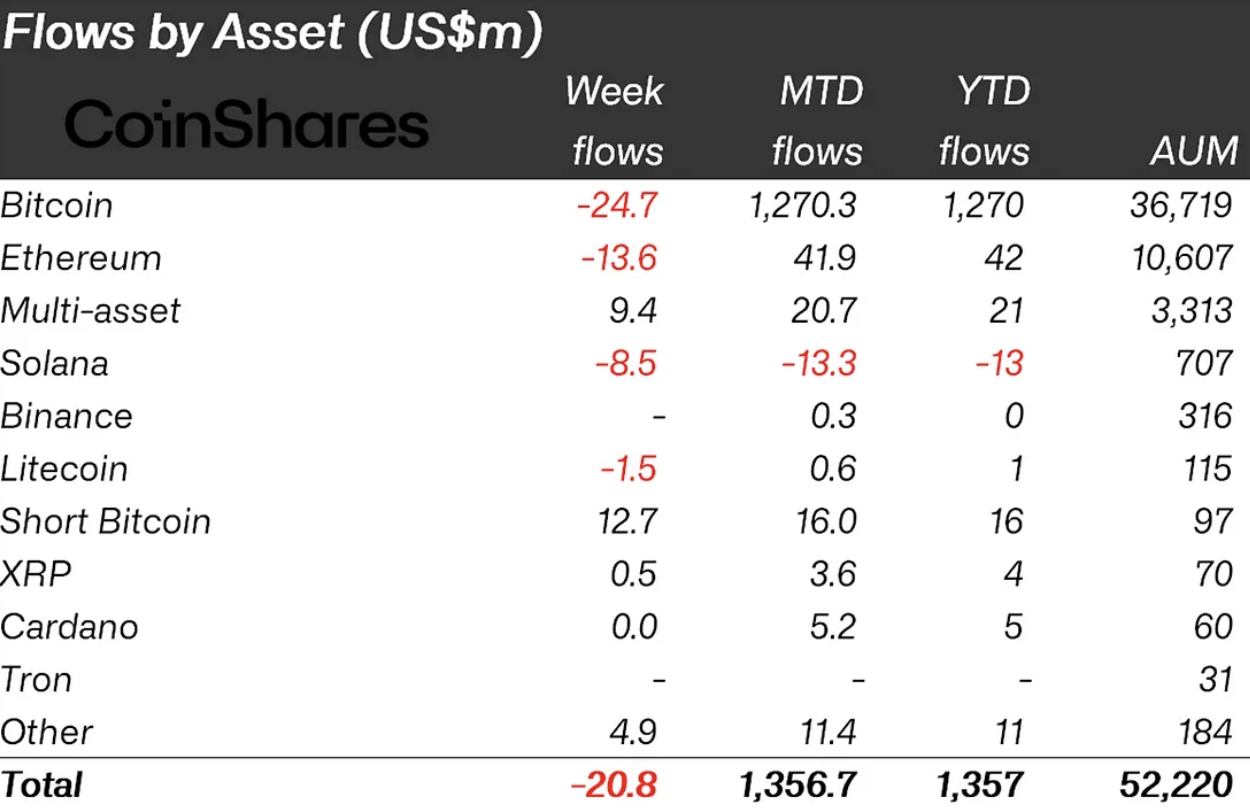

In the face of a challenging week for digital asset investment products, XRP emerges as the sole beacon of positivity, showcasing resilience in the volatile market. Coinshares' latest weekly report reveals a setback with minor outflows totaling $21 million across digital assets, particularly impacting higher-cost issuers in the U.S.

Notably, since the launch of spot-based ETFs on Jan. 11, 2024, incumbent players suffered a significant blow with $2.9 billion in outflows.

However, amid the gloom, the report presents a silver lining. The data illustrates a noteworthy influx of over half a million dollars into investment products, particularly those focused on the popular cryptocurrency XRP. The digital asset stands as the only alternative to Bitcoin that witnessed a positive capital flow, recording an impressive $4 million since the beginning of the year.

The hit

The market's major hit came from Grayscale's decision to sell its Bitcoin holdings from the GBTC trust, contributing to the overall setback. Even with the introduction of new ETFs, which garnered $4.13 billion in inflows since their launch, they were unable to compensate for the losses suffered by higher-cost incumbent ETPs.

Investors leveraged the recent price weakness to capitalize on short-Bitcoin investment products, with inflows there and minor outflows of $25 million for Bitcoin itself.

As the digital asset landscape navigates through challenges, XRP's resilience and positive capital flow underscore its appeal among investors.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin