Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Following the brutal crypto market shakeout in the last hour, XRP experienced one of the most unbalanced liquidation events in recent trading history, with long positions accounting for $37.85 million in losses compared to just $360,000 from shorts — creating a massive 10,409% imbalance, according to CoinGlass.

The liquidation wave hit hardest when XRP dropped from $3.38 to $3.26 and triggered a chain reaction of forced position closures that contributed big to the $167.79 million in total crypto liquidations during that hourly bloodbath.

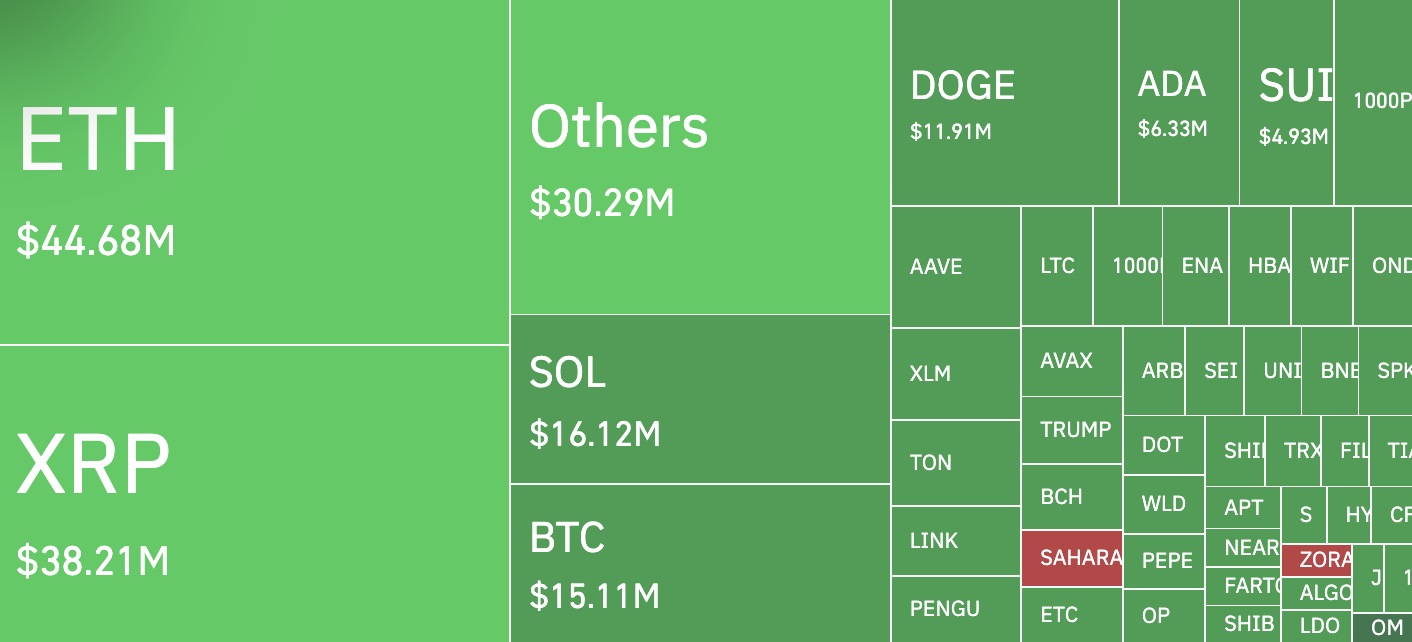

What stands out is how XRP managed to claim the second-highest liquidation volume at $38.21 million over 24 hours, behind only Ethereum's $44.68 million despite having a smaller overall market presence — a stark display of it being among the most popular trading options on the market right now.

At the same time, the mathematics behind the liquidation imbalance reveal just how concentrated long positions had become, with average long trade more than 100 times larger than the average short position.

This kind of positioning creates conditions where relatively modest price movements can snowball into much larger market disruptions as overleveraged traders get forced out of their positions simultaneously.

Across the broader cryptocurrency market, 175,039 traders faced liquidations in the 24-hour period, with total losses reaching $507.85 million and long positions representing $380.66 million of that figure.

With upcoming Federal Reserve communications and fewer immediate catalysts driving crypto markets, the liquidation event looks more like a natural correction of excessively greedy positioning that had formed in recent trading sessions.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin