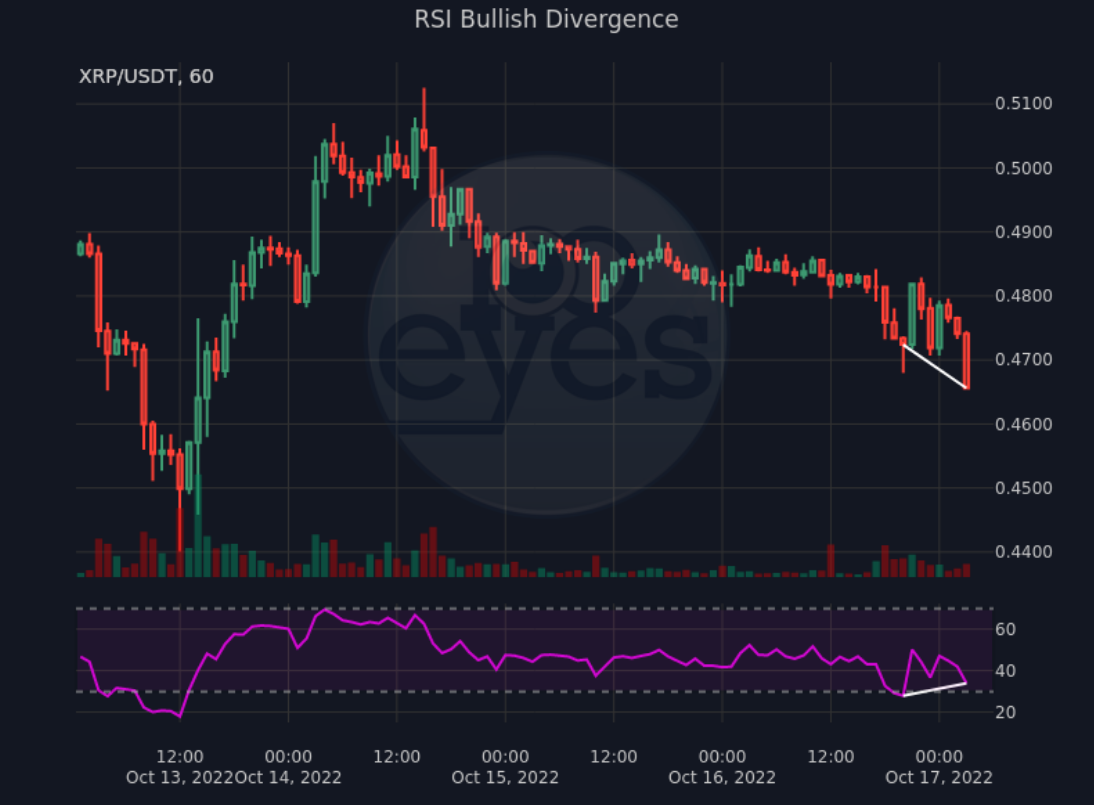

The XRP token is seemingly confirming a bullish divergence on its hourly chart, according to the 100eyes Crypto Scanner account.

Traders can spot divergencies based on the relative strength index (RSI), a momentum indicator used in technical analysis. It is displayed on an oscillator, which ranges from 0 to 100.

An asset is considered to be oversold if the RSI drops below 30. At the same time, overbought conditions occur if there is an RSI reading above 70.

The indicator is useful for those who want to determine the right time to buy or sell a certain asset. They can do this by monitoring divergences that occur between the momentum and the price.

A bullish divergence can be spotted when the RSI makes a higher low in spite of bearish price action. This suggests possible bullish momentum that can be interpreted as a buying opportunity by some traders.

The XRP token is down 1.66% over the last 24 hours, and the Ripple-affiliated cryptocurrency is now on track to record its third consecutive day in the red.

The token is down roughly 13% over the last week even. On Oct. 14, it managed to soar roughly 7% after the U.S. stock market managed to mount a stunning comeback. However, this momentum quickly faded.

Concerns about the U.S. Federal Reserve’s hawkish policy remain front and center for market participants.

The token is down 86.22% from its record peak that was recorded all the way back in 2018.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov