Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

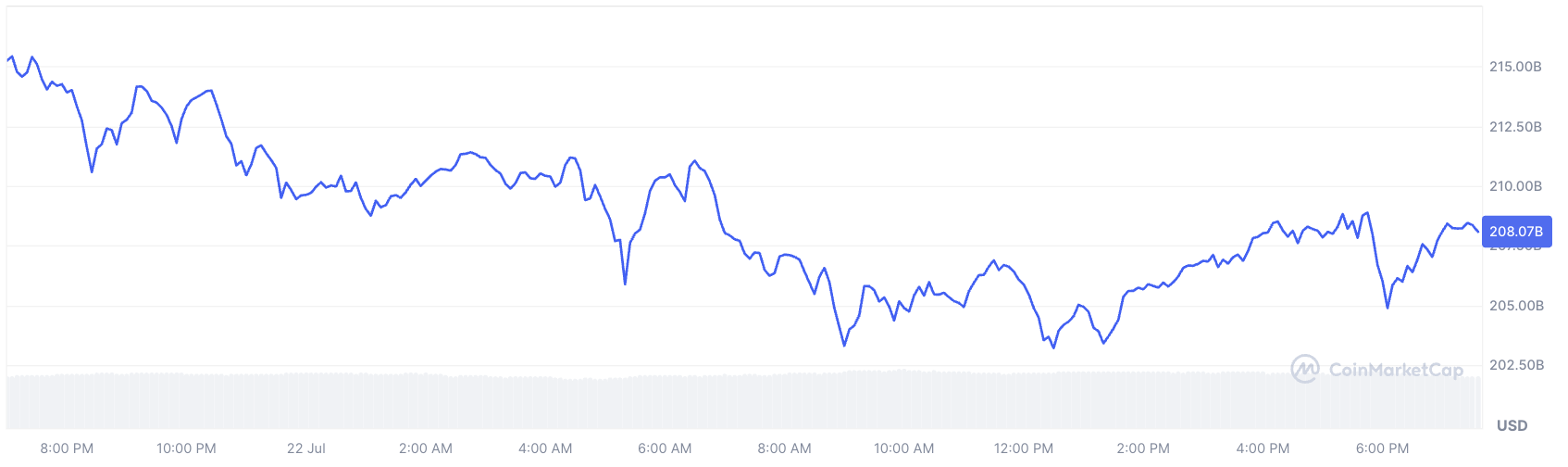

XRP has just lost over $7 billion in market capitalization, falling from $215 billion to around $208 billion in less than a day — its biggest one-day loss for weeks. This decline coincided with a broader cooling-off period on the crypto market, with the global market cap falling by 1.1% and over $556 million being liquidated across trading platforms.

Even Bitcoin was not spared, with the first ETF outflow since early June being recorded.

The hourly candles tell the story clearly. XRP experienced its worst hourly sell-off of the day, dropping from $3.51 to $3.42 before partially recovering.

This pullback is due not only to local volatility but also to a familiar post-euphoria lull. Just as activity dipped after the regulatory buzz of Crypto Week, the current silence has left the market vulnerable to minor shocks and opportunistic profit-taking.

It is not unusual to see a correction after XRP price gained over 50% in 13 days, especially given that it is already a coin with a market cap in the hundreds of billions of dollars.

There were also warning signs, as altcoin open interest has once again approached Bitcoin’s share — a pattern that has preceded sharp corrections in the past. Historically, when altcoin exposure grows too quickly relative to Bitcoin, it is followed by a wave of deleveraging.

With XRP struggling to regain its earlier highs and markets awaiting macroeconomic signals, this may not signal the end of the bull run.

However, it could indicate a pause in the overheated chase that has characterized the market recently.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin