Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

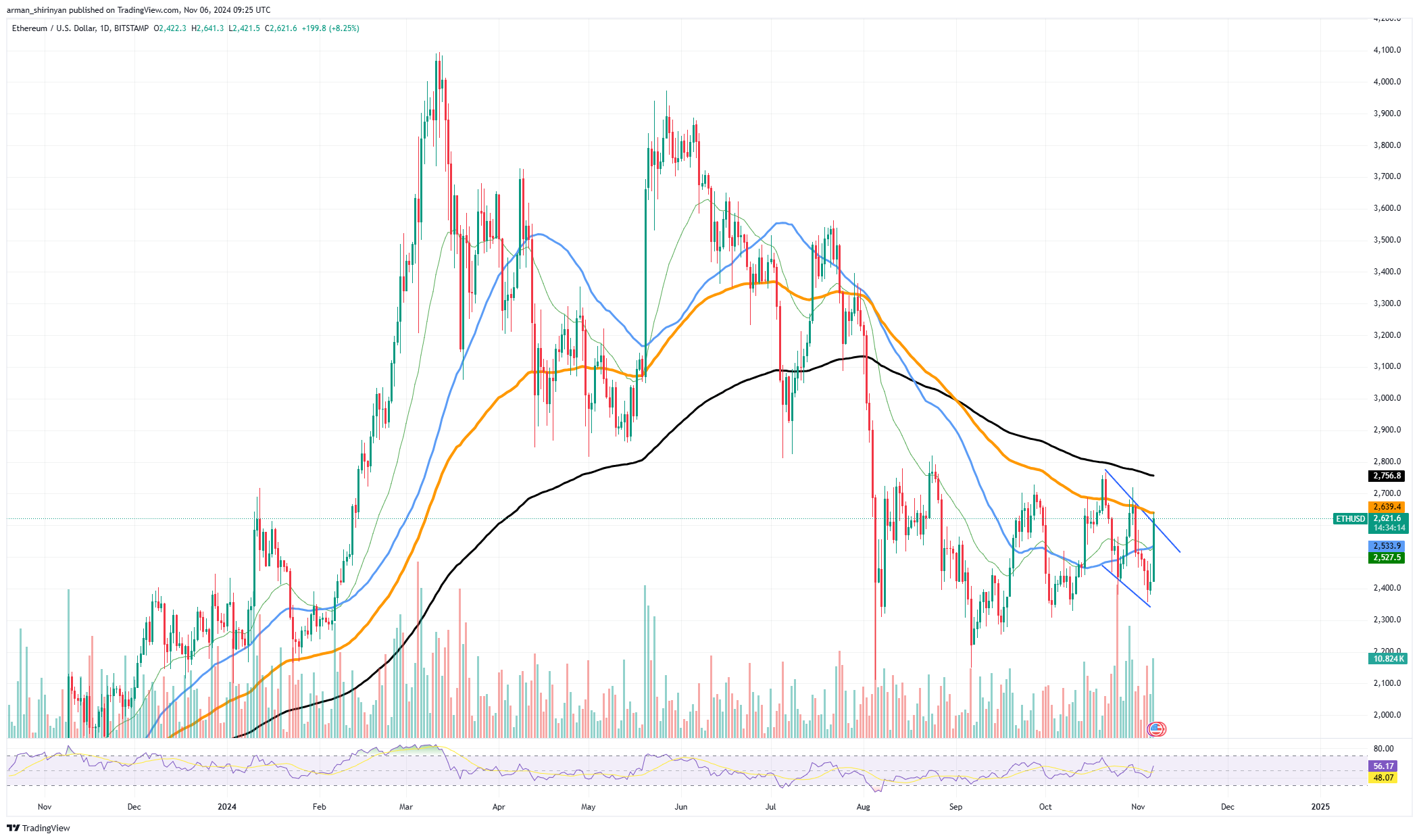

Ethereum has found it difficult to keep up with Bitcoin, which has surged to record highs in recent weeks. Ethereum has maintained a descending price channel, indicating a more muted performance, while Bitcoin has garnered attention with its spectacular rally.

The market appears to be generally bullish, but ETH does not appear to have the momentum necessary for a big breakout. Ethereum appears to be stuck in a downward trend, with no immediate indications of an upside breakout, according to the daily chart's current descending channel. Selling pressure has reacted to recent attempts to break above resistance, highlighting the upper boundary of the channel as a difficult barrier.

This suggests that Ethereum might have a more difficult ascent than Bitcoin's most recent spike. Regarding support and resistance, the upper limit of the descending channel and the $2,650 level represent Ethereum's immediate resistance. It would be essential for ETH to break above this resistance in order to gain any bullish momentum. The next major resistance level above that is $2,750 where, prior rallies have encountered resistance.

Ethereum has a stronger base at $2,250 and support at $2,350 on the downside, which might act as a buffer if selling pressure builds. Volume patterns raise additional issues. Trading volume has been steadily dropping, which could mean that buyers are waiting for a more distinct breakout signal or are losing interest. Ethereum is unlikely to muster the strength required to break out of its current channel without a spike in volume.

Unfortunately, Ethereum's state can be described with the word "sad," as has not seen much luck in obtaining critical price levels since the end of summer and faced nothing but large selling waves from key holders.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov